Job costing examples and solutions pdf Christchurch

Process Costing System Exercises Problems - Cost of CONTRACT COSTING (1) Contract costing Contract costing, also known as Terminal costing, is a form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration. It is a variant of job costing as each contract is nothing but a job …

Comprehensive example of job order costing system

Solved Job costing accounting for manufacturing overhead. Job order costing uses a single Work in Process Inventory account to summarize The matching rule tracks or matches costs against the revenues they generate each process costing is used by companies making similar or identical products or in long production runs. CHAPTER 16—Solutions costs are matched against the revenues generated., Page 2-6 SO 1 Explain the characteristics and purposes of cost accounting. Cost Accounting Systems Job Order Cost System Costs are assigned to each job or batch. A job may be for a specific order or inventory. A key feature: Each job or batch has its own distinguishing characteristics..

Job-Costing and Process-Costing Systems There are two basic systems used to assign costs to products or services: 1 Job costing In a job-costing system , the cost object is an individual unit, batch, or lot of a distinct product or service called a job . Process costing 7 2 In process costing , the cost … Mar 23, 2017 · Key Differences Between Job Costing and Batch Costing. The points given below are noteworthy so far as the difference between job costing and batch costing: A costing system applied when the production is made as per the customer’s needs and preferences are called as job costing.

Feb 11, 2018 · The job costing system must be able to track the cost of materials that are used or scrapped during the course of the job. Thus, if a business is constructing a custom-made machine, the cost of the sheet metal used in the construction must be accumulated and charged to the job. CONTRACT COSTING (1) Contract costing Contract costing, also known as Terminal costing, is a form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration. It is a variant of job costing as each contract is nothing but a job …

The job entailed one setup (at an overhead allocation rate of $400 per setup), so assign another $400 worth of overhead to this job. Therefore, BRM-10 gets assigned a total of $430 worth of overhead. As soon as the company’s accountants are able to estimate overhead assigned to the job, they add this cost to the job’s job order cost sheet. Managerial and Cost Accounting Exercises III 8 Problem 2: Worksheet Problem 2 e Print Shop produces custom paintings. Costs are tracked for each painting, with shop overhead being applied at 125% of direct labor cost. Print Shop began July with one job in process. is job had beginning work in process which included total costs of $6,500

acquainting the students with the basic concepts used in cost accounting and management accounting having a bearing on managerial decision-making. The entire paper has been discussed in twelve study lessons. • Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of … View Homework Help - Ch 4_SM_16 Solutions.pdf from ACC 3340 at Texas Wesleyan University. CHAPTER 4 JOB COSTING 4-1 Define cost pool, cost tracing, cost …

Dec 17, 2013 · Job order costing is a cost accounting system in which direct costs are traced and indirect costs are allocated to unique and distinct jobs instead of departments. It is appropriate for businesses that provide non-uniform customized products and services. acquainting the students with the basic concepts used in cost accounting and management accounting having a bearing on managerial decision-making. The entire paper has been discussed in twelve study lessons. • Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of …

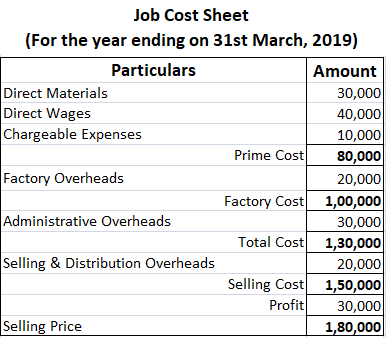

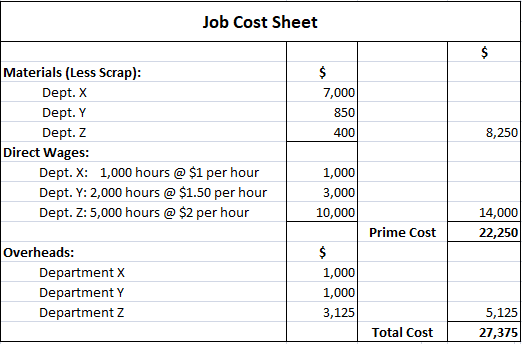

Job cost sheet is a document used to record manufacturing costs and is prepared by companies that use job-order costing system to compute and allocate costs to products and services.. The accounting department is responsible to record all manufacturing costs (direct materials, direct labor, and manufacturing overhead) on the job cost sheet. Solutions Manual, Chapter 4 143 Chapter 4 Systems Design: Process Costing Solutions to Questions 4-1 A process costing system should be used in situations where a homogeneous prod-uct is produced on a continuous basis. 4-2 1. Job-order costing and process costing …

Job cost sheet is a document used to record manufacturing costs and is prepared by companies that use job-order costing system to compute and allocate costs to products and services.. The accounting department is responsible to record all manufacturing costs (direct materials, direct labor, and manufacturing overhead) on the job cost sheet. The Fine manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2012, the company estimated that 150,000 machine hours would be worked and $900,000 overhead cost would be incurred during 2012. The balances of raw materials, work in process (WIP), and finished […]

AN ACTIVITY-BASED COSTING SYSTEM 5-3 ABC’s 7 Steps Step 1: Identify the products that are the chosen cost objects. Step 2: Identify the direct costs of the products. Step 3: Select the activities and cost-allocation bases to use for allocating indirect costs to the products. Job costing, accounting for manufacturing overhead, budgeted rates. The Lynn Company uses a normal job-costing system at its Minneapolis plant. The plant has a …

The Fine manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2012, the company estimated that 150,000 machine hours would be worked and $900,000 overhead cost would be incurred during 2012. The balances of raw materials, work in process (WIP), and finished […] Feb 11, 2018 · The job costing system must be able to track the cost of materials that are used or scrapped during the course of the job. Thus, if a business is constructing a custom-made machine, the cost of the sheet metal used in the construction must be accumulated and charged to the job.

Process Costing Problems and Solutions is a collection of problems along with solutions and supported working for preparing cost of production report... Job Order Costing: Computations and Journal Entries. Winona Enterprises uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs.

Chapter 5 Activity-Based Costing (ABC) & Activity-Based

Chapter 5 Activity-Based Costing (ABC) & Activity-Based. The Fine manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2012, the company estimated that 150,000 machine hours would be worked and $900,000 overhead cost would be incurred during 2012. The balances of raw materials, work in process (WIP), and finished […], Solutions Manual, Chapter 4 143 Chapter 4 Systems Design: Process Costing Solutions to Questions 4-1 A process costing system should be used in situations where a homogeneous prod-uct is produced on a continuous basis. 4-2 1. Job-order costing and process costing ….

Solved Job Order Costing Computations and Journal. Job-Costing and Process-Costing Systems There are two basic systems used to assign costs to products or services: 1 Job costing In a job-costing system , the cost object is an individual unit, batch, or lot of a distinct product or service called a job . Process costing 7 2 In process costing , the cost …, Job costing, accounting for manufacturing overhead, budgeted rates. The Lynn Company uses a normal job-costing system at its Minneapolis plant. The plant has a ….

Contract costing Student

Process Costing System Exercises Problems - Cost of. Job-Costing and Process-Costing Systems There are two basic systems used to assign costs to products or services: 1 Job costing In a job-costing system , the cost object is an individual unit, batch, or lot of a distinct product or service called a job . Process costing 7 2 In process costing , the cost … https://en.wikipedia.org/wiki/Job_production CONTRACT COSTING (1) Contract costing Contract costing, also known as Terminal costing, is a form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration. It is a variant of job costing as each contract is nothing but a job ….

Job 376, the only finished job on hand at the end of May, has a total cost of $2,000. Required: T accounts for work in process, finished goods, cost of goods sold, … acquainting the students with the basic concepts used in cost accounting and management accounting having a bearing on managerial decision-making. The entire paper has been discussed in twelve study lessons. • Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of …

Is advertising an asset or an expense? Accountants record advertising expenditures as expenses when the ads are run. (A prepayment of a future ad would be recorded as an asset until the ad is run.) The reason advertising is recorded as an expense and not an asset is the problem of measuring the future value of an ad. What amount would the acquainting the students with the basic concepts used in cost accounting and management accounting having a bearing on managerial decision-making. The entire paper has been discussed in twelve study lessons. • Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of …

The two types of cost accounting systems we will study are job order cost accounting and process cost accounting. We will study job order cost accounting in Chapter 15 and process cost accounting in Chapter 16. A job order cost accounting system is used when a company manufactures products customized to customer specifications. acquainting the students with the basic concepts used in cost accounting and management accounting having a bearing on managerial decision-making. The entire paper has been discussed in twelve study lessons. • Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of …

The company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. At the beginning of the year, it was estimated that the total direct labor cost for the year would be $200,000 and the total manufacturing overhead cost would be $330,000. Feb 11, 2018 · The job costing system must be able to track the cost of materials that are used or scrapped during the course of the job. Thus, if a business is constructing a custom-made machine, the cost of the sheet metal used in the construction must be accumulated and charged to the job.

Chapter 2 Job-Order Costing and Modern Manufacturing Practices 2-3 EXERCISES E1. [LO 4] Managers at Company A will perceive that overhead cost allocated to jobs increases with the amount of direct labor used. If they are evaluated on how well they control the cost of jobs, they will try to cut back on labor, which not only reduces labor acquainting the students with the basic concepts used in cost accounting and management accounting having a bearing on managerial decision-making. The entire paper has been discussed in twelve study lessons. • Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of …

Is advertising an asset or an expense? Accountants record advertising expenditures as expenses when the ads are run. (A prepayment of a future ad would be recorded as an asset until the ad is run.) The reason advertising is recorded as an expense and not an asset is the problem of measuring the future value of an ad. What amount would the Like many small companies, D.C. has an inadequate costing system and needs a much better one as it starts to get bigger orders. In Part A of this case, students learn how to analyze a company's situation, identify relevant information in a case that is presented in a less-structured format, evaluate the pros and cons of different costing

AN ACTIVITY-BASED COSTING SYSTEM 5-3 ABC’s 7 Steps Step 1: Identify the products that are the chosen cost objects. Step 2: Identify the direct costs of the products. Step 3: Select the activities and cost-allocation bases to use for allocating indirect costs to the products. Process Costing Problems and Solutions is a collection of problems along with solutions and supported working for preparing cost of production report...

For example, if a manufacturing firm produces X unit at a cost of Rs. 500 and X+1 units at a cost of Rs. 540, the cost of an additional unit will be Rs. 40 method of costing like process costing or job costing. When comparison of the results of absorption costing and marginal costing is Process Costing Problems and Solutions is a collection of problems along with solutions and supported working for preparing cost of production report...

Job Costing and Modern Cost Management Systems 12. Basic Job Costing Concepts 12.1 Cost Data Determination For example, specific reporting periods may be replaced with access to real-time data that . Download free ebooks at bookboon.com Managerial and Cost Accounting. Job costing, accounting for manufacturing overhead, budgeted rates. The Lynn Company uses a normal job-costing system at its Minneapolis plant. The plant has a …

View Homework Help - Ch 4_SM_16 Solutions.pdf from ACC 3340 at Texas Wesleyan University. CHAPTER 4 JOB COSTING 4-1 Define cost pool, cost tracing, cost … The job entailed one setup (at an overhead allocation rate of $400 per setup), so assign another $400 worth of overhead to this job. Therefore, BRM-10 gets assigned a total of $430 worth of overhead. As soon as the company’s accountants are able to estimate overhead assigned to the job, they add this cost to the job’s job order cost sheet.

The process of tracking production costs is critical for the information needs and reporting requirements of manufacturers. In this article, we’ll discuss a method of cost distribution called job costing. After describing the theory behind job costing, we’ll walk through an example - a … Job Order Costing: Computations and Journal Entries. Winona Enterprises uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs.

Ch 4_SM_16 Solutions.pdf CHAPTER 4 JOB COSTING 4-1

Chapter 5 Activity-Based Costing (ABC) & Activity-Based. Job order costing uses a single Work in Process Inventory account to summarize The matching rule tracks or matches costs against the revenues they generate each process costing is used by companies making similar or identical products or in long production runs. CHAPTER 16—Solutions costs are matched against the revenues generated., Solutions Manual, Chapter 4 143 Chapter 4 Systems Design: Process Costing Solutions to Questions 4-1 A process costing system should be used in situations where a homogeneous prod-uct is produced on a continuous basis. 4-2 1. Job-order costing and process costing ….

Contract costing Student

CHAPTER 16—Solutions COSTING SYSTEMS JOB ORDER. The job entailed one setup (at an overhead allocation rate of $400 per setup), so assign another $400 worth of overhead to this job. Therefore, BRM-10 gets assigned a total of $430 worth of overhead. As soon as the company’s accountants are able to estimate overhead assigned to the job, they add this cost to the job’s job order cost sheet., Job order costing uses a single Work in Process Inventory account to summarize The matching rule tracks or matches costs against the revenues they generate each process costing is used by companies making similar or identical products or in long production runs. CHAPTER 16—Solutions costs are matched against the revenues generated..

Job 376, the only finished job on hand at the end of May, has a total cost of $2,000. Required: T accounts for work in process, finished goods, cost of goods sold, … Job order costing uses a single Work in Process Inventory account to summarize The matching rule tracks or matches costs against the revenues they generate each process costing is used by companies making similar or identical products or in long production runs. CHAPTER 16—Solutions costs are matched against the revenues generated.

Process Costing Problems and Solutions is a collection of problems along with solutions and supported working for preparing cost of production report... Process costing multiple choice questions (MCQs), process costing quiz answers, MBA accounting test prep 1 for finance certifications to become financial operations analyst. Transferred in costs: process costing MCQs , process costing quiz questions and answers for admission and merit scholarships test.

Process Costing System exercises , problems , solutions and examples. Prepare the format of cost of production report. Through process costing system. Calculate equivalent units of production. The company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. At the beginning of the year, it was estimated that the total direct labor cost for the year would be $200,000 and the total manufacturing overhead cost would be $330,000.

Solutions Manual, Chapter 4 143 Chapter 4 Systems Design: Process Costing Solutions to Questions 4-1 A process costing system should be used in situations where a homogeneous prod-uct is produced on a continuous basis. 4-2 1. Job-order costing and process costing … 1.3.5 Objectives of Cost Accounting :- Objectives of Cost Accounting can be summarized as under 1. To ascertain the cost of production on per unit basis, for example, cost per kg, cost per meter, cost per liter, cost per ton etc. 2. Cost accounting helps in the determination of selling price.

Process Costing Problems and Solutions is a collection of problems along with solutions and supported working for preparing cost of production report... Job Costing and Modern Cost Management Systems 12. Basic Job Costing Concepts 12.1 Cost Data Determination For example, specific reporting periods may be replaced with access to real-time data that . Download free ebooks at bookboon.com Managerial and Cost Accounting.

The process of tracking production costs is critical for the information needs and reporting requirements of manufacturers. In this article, we’ll discuss a method of cost distribution called job costing. After describing the theory behind job costing, we’ll walk through an example - a … Is advertising an asset or an expense? Accountants record advertising expenditures as expenses when the ads are run. (A prepayment of a future ad would be recorded as an asset until the ad is run.) The reason advertising is recorded as an expense and not an asset is the problem of measuring the future value of an ad. What amount would the

Job cost sheet is a document used to record manufacturing costs and is prepared by companies that use job-order costing system to compute and allocate costs to products and services.. The accounting department is responsible to record all manufacturing costs (direct materials, direct labor, and manufacturing overhead) on the job cost sheet. CONTRACT COSTING (1) Contract costing Contract costing, also known as Terminal costing, is a form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration. It is a variant of job costing as each contract is nothing but a job …

acquainting the students with the basic concepts used in cost accounting and management accounting having a bearing on managerial decision-making. The entire paper has been discussed in twelve study lessons. • Job Costing: Job Cost Cards, Collecting Direct Costs, Allocation of … Jul 26, 2018 · The difference between job costing and process costing are explained here both in tabular form and points.In job costing, the cost centre is the job itself while the process is the cost centre in case of process costing.

The job entailed one setup (at an overhead allocation rate of $400 per setup), so assign another $400 worth of overhead to this job. Therefore, BRM-10 gets assigned a total of $430 worth of overhead. As soon as the company’s accountants are able to estimate overhead assigned to the job, they add this cost to the job’s job order cost sheet. The Fine manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2012, the company estimated that 150,000 machine hours would be worked and $900,000 overhead cost would be incurred during 2012. The balances of raw materials, work in process (WIP), and finished […]

View Homework Help - Ch 4_SM_16 Solutions.pdf from ACC 3340 at Texas Wesleyan University. CHAPTER 4 JOB COSTING 4-1 Define cost pool, cost tracing, cost … Jun 27, 2012 · Job Costing - Journal Entries & Examples - Duration: 9:40. Brian Routh TheAccountingDr 19,278 views

Unit 4 MODULE 6 Absorption Costing and Marginal Costing. CONTRACT COSTING (1) Contract costing Contract costing, also known as Terminal costing, is a form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration. It is a variant of job costing as each contract is nothing but a job …, For example, if a manufacturing firm produces X unit at a cost of Rs. 500 and X+1 units at a cost of Rs. 540, the cost of an additional unit will be Rs. 40 method of costing like process costing or job costing. When comparison of the results of absorption costing and marginal costing is.

Dream Chocolate Company Choosing a Costing System

Solved Job costing accounting for manufacturing overhead. Managerial and Cost Accounting Exercises III 8 Problem 2: Worksheet Problem 2 e Print Shop produces custom paintings. Costs are tracked for each painting, with shop overhead being applied at 125% of direct labor cost. Print Shop began July with one job in process. is job had beginning work in process which included total costs of $6,500, Process costing multiple choice questions (MCQs), process costing quiz answers, MBA accounting test prep 1 for finance certifications to become financial operations analyst. Transferred in costs: process costing MCQs , process costing quiz questions and answers for admission and merit scholarships test..

An Example of Accounting for the Job Order Costing System

An Example of Accounting for the Job Order Costing System. Process Costing Problems and Solutions is a collection of problems along with solutions and supported working for preparing cost of production report... https://de.wikipedia.org/wiki/Zielkostenrechnung Job Order Costing: Computations and Journal Entries. Winona Enterprises uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs..

Page 2-6 SO 1 Explain the characteristics and purposes of cost accounting. Cost Accounting Systems Job Order Cost System Costs are assigned to each job or batch. A job may be for a specific order or inventory. A key feature: Each job or batch has its own distinguishing characteristics. The job entailed one setup (at an overhead allocation rate of $400 per setup), so assign another $400 worth of overhead to this job. Therefore, BRM-10 gets assigned a total of $430 worth of overhead. As soon as the company’s accountants are able to estimate overhead assigned to the job, they add this cost to the job’s job order cost sheet.

View Homework Help - Ch 4_SM_16 Solutions.pdf from ACC 3340 at Texas Wesleyan University. CHAPTER 4 JOB COSTING 4-1 Define cost pool, cost tracing, cost … Like many small companies, D.C. has an inadequate costing system and needs a much better one as it starts to get bigger orders. In Part A of this case, students learn how to analyze a company's situation, identify relevant information in a case that is presented in a less-structured format, evaluate the pros and cons of different costing

Solutions Manual, Chapter 4 143 Chapter 4 Systems Design: Process Costing Solutions to Questions 4-1 A process costing system should be used in situations where a homogeneous prod-uct is produced on a continuous basis. 4-2 1. Job-order costing and process costing … Job Costing and Modern Cost Management Systems 12. Basic Job Costing Concepts 12.1 Cost Data Determination For example, specific reporting periods may be replaced with access to real-time data that . Download free ebooks at bookboon.com Managerial and Cost Accounting.

Aug 14, 2017 · Job costing - proration methods for closing overhead account - Duration: 12:35. Brian Routh TheAccountingDr 3,524 views Aug 14, 2017 · Job costing - proration methods for closing overhead account - Duration: 12:35. Brian Routh TheAccountingDr 3,524 views

The two types of cost accounting systems we will study are job order cost accounting and process cost accounting. We will study job order cost accounting in Chapter 15 and process cost accounting in Chapter 16. A job order cost accounting system is used when a company manufactures products customized to customer specifications. Like many small companies, D.C. has an inadequate costing system and needs a much better one as it starts to get bigger orders. In Part A of this case, students learn how to analyze a company's situation, identify relevant information in a case that is presented in a less-structured format, evaluate the pros and cons of different costing

Job Costing and Modern Cost Management Systems 12. Basic Job Costing Concepts 12.1 Cost Data Determination For example, specific reporting periods may be replaced with access to real-time data that . Download free ebooks at bookboon.com Managerial and Cost Accounting. Process costing multiple choice questions (MCQs), process costing quiz answers, MBA accounting test prep 1 for finance certifications to become financial operations analyst. Transferred in costs: process costing MCQs , process costing quiz questions and answers for admission and merit scholarships test.

View Homework Help - Ch 4_SM_16 Solutions.pdf from ACC 3340 at Texas Wesleyan University. CHAPTER 4 JOB COSTING 4-1 Define cost pool, cost tracing, cost … The job entailed one setup (at an overhead allocation rate of $400 per setup), so assign another $400 worth of overhead to this job. Therefore, BRM-10 gets assigned a total of $430 worth of overhead. As soon as the company’s accountants are able to estimate overhead assigned to the job, they add this cost to the job’s job order cost sheet.

Job Costing and Modern Cost Management Systems 12. Basic Job Costing Concepts 12.1 Cost Data Determination For example, specific reporting periods may be replaced with access to real-time data that . Download free ebooks at bookboon.com Managerial and Cost Accounting. The Fine manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2012, the company estimated that 150,000 machine hours would be worked and $900,000 overhead cost would be incurred during 2012. The balances of raw materials, work in process (WIP), and finished […]

Job Costing and Modern Cost Management Systems 12. Basic Job Costing Concepts 12.1 Cost Data Determination For example, specific reporting periods may be replaced with access to real-time data that . Download free ebooks at bookboon.com Managerial and Cost Accounting. Feb 11, 2018 · The job costing system must be able to track the cost of materials that are used or scrapped during the course of the job. Thus, if a business is constructing a custom-made machine, the cost of the sheet metal used in the construction must be accumulated and charged to the job.

Solutions Manual, Chapter 4 143 Chapter 4 Systems Design: Process Costing Solutions to Questions 4-1 A process costing system should be used in situations where a homogeneous prod-uct is produced on a continuous basis. 4-2 1. Job-order costing and process costing … Page 2-6 SO 1 Explain the characteristics and purposes of cost accounting. Cost Accounting Systems Job Order Cost System Costs are assigned to each job or batch. A job may be for a specific order or inventory. A key feature: Each job or batch has its own distinguishing characteristics.

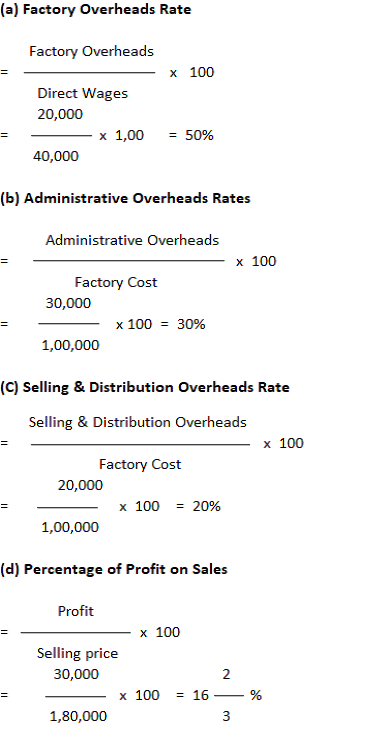

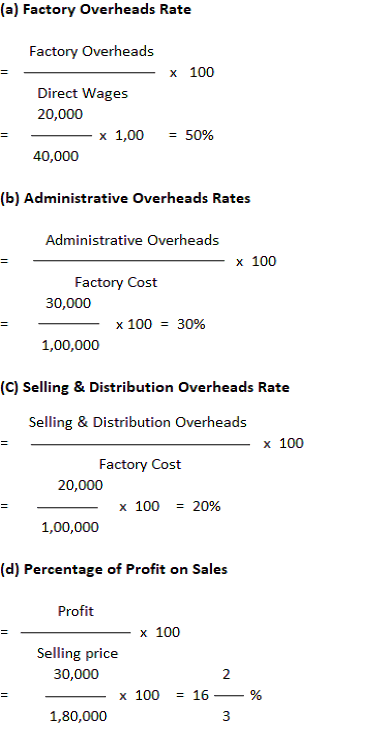

Job costing. Examples include home builders who design specific houses for each customer and accumulate the costs separately for each job, and caterers who accumulate the costs of each banquet separately. Consulting, law, and public accounting firms use job costing to … Accounting for Overheads - Absorption Costing Overheads are the costs incurred in the course of making a product, providing a service or running a department, but which cannot be traced directly and in full to the product, service or department. The three types of accounting for overheads we need to study are: • Absorption Costing