Employment Agreement Builder Business.govt.nz For many, the chance to set your own salary sounds like a dream come true. But small business owners know the reality is a little more complicated. You should only pay yourself out of your profits – not your revenue. When you see money coming into your business, don’t assume you can pay yourself

IT salary guide Trade Me Jobs

Taxes for self-employed japan-guide.com forum. Jul 29, 2019 · For business owners, business expenses are generally tax-deductible — and keeping track of them will go a long way to reducing your tax liabilities. Use This Guide to Business and Personal Travel Deductibles. 19 Self-Employment Deductions You Shouldn't Miss. Cost of Goods Sold (Cost of Sales), Explained., Sep 15, 2019 · New Zealand resident companies are taxed on their worldwide income, and non-resident companies (including branches) are taxed on their New Zealand-sourced income, subject to any applicable DTA. The New Zealand corporate income tax (CIT) rate is 28%. Local income taxes. There are no state or municipal income taxes in New Zealand..

New Zealand has 7 international airports and is serviced by all major airlines. Business Start-up Potential: The process of setting-up a business in New Zealand takes approximately three days, and is known for its ease and simplicity. The OECD ranks New Zealand 3rd for … New Zealand has 7 international airports and is serviced by all major airlines. Business Start-up Potential: The process of setting-up a business in New Zealand takes approximately three days, and is known for its ease and simplicity. The OECD ranks New Zealand 3rd for …

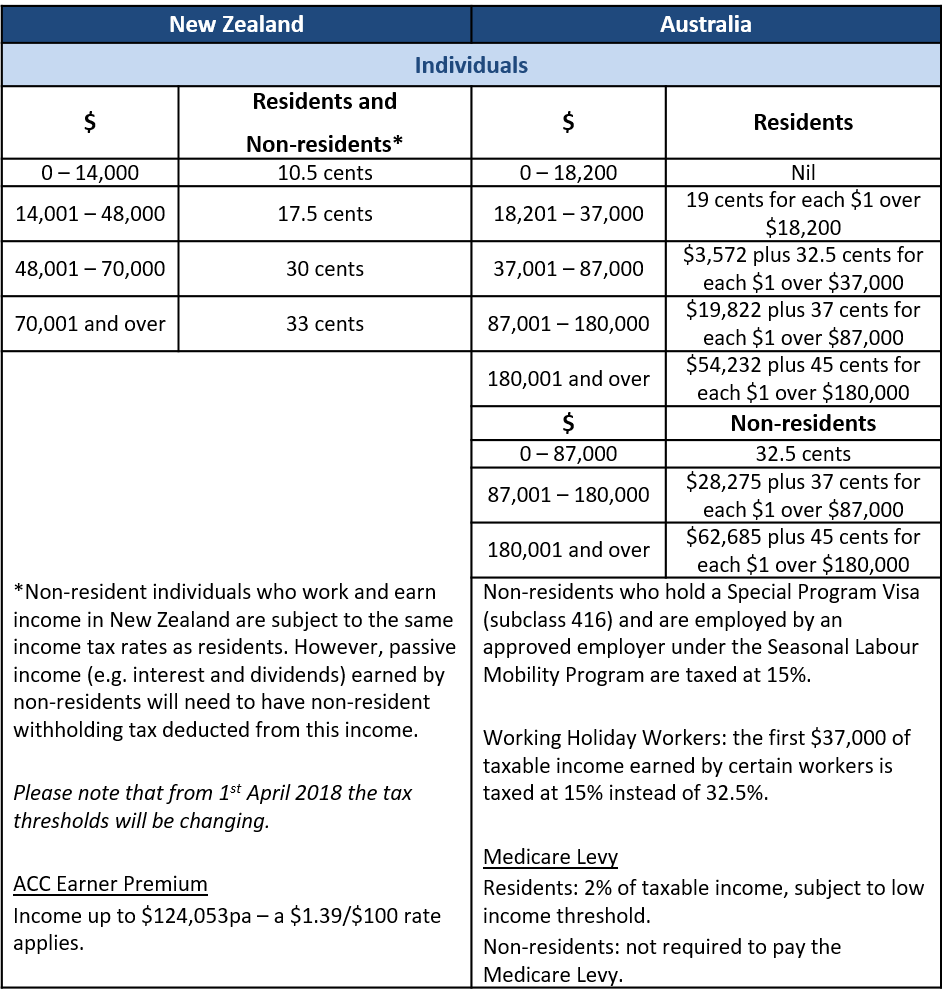

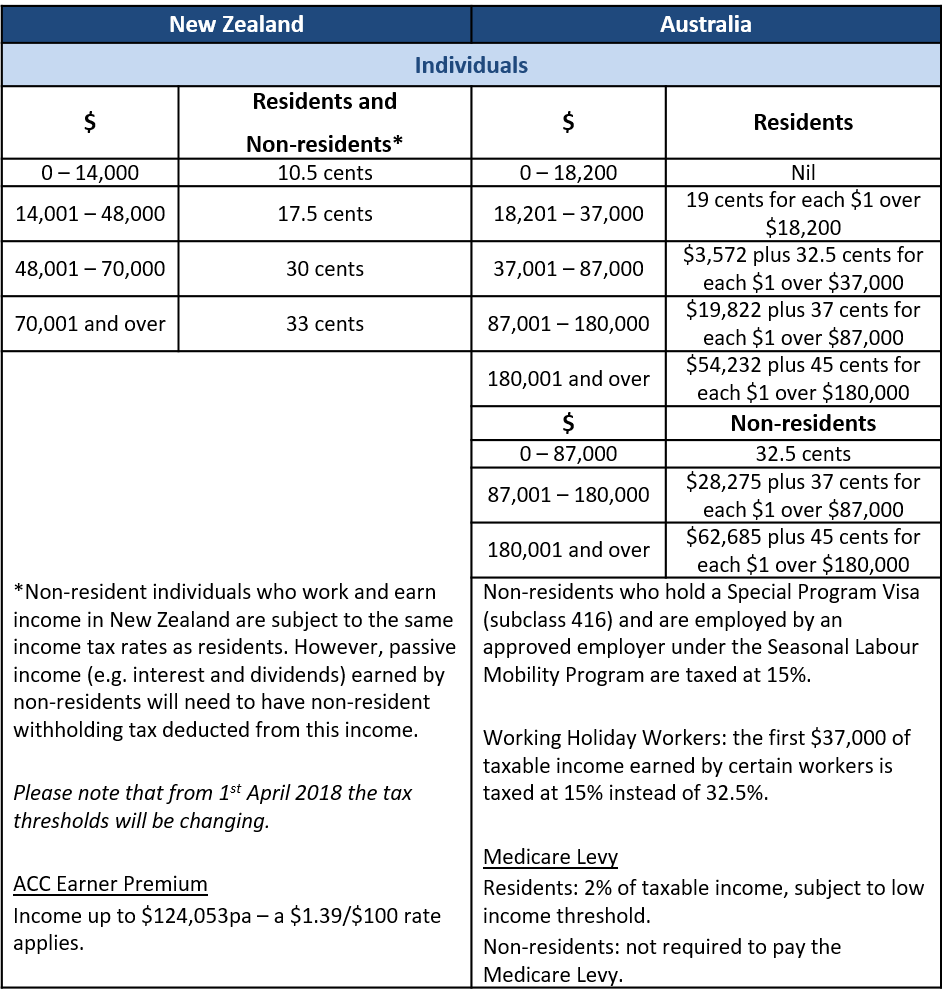

You need a separate tax code for each source of income which has tax deducted before it's paid to you. Tax rates for individuals Main and secondary income tax rates, tailored and schedular tax rates, and a calculator to work out your tax. Tax rates for businesses How … Against a backdrop of an OECD average corporate tax rate of 22 percent, an Australian destination of 25 percent, and the flow-on impacts of the US proposals to reduce its corporate tax rate to 15 percent, providing some signal on the future direction for corporate tax would have been welcome to …

May 10, 2013 · Working as a contractor may seem a great way to be self-employed and find a better work-life balance, or just a good way to find work when full … May 10, 2013 · Working as a contractor may seem a great way to be self-employed and find a better work-life balance, or just a good way to find work when full …

Most individuals, businesses and organisations that get an income in New Zealand need to file an income tax return. Setting up a business or organisation Registering your business or organisation, getting an IRD number, registering for GST, and other start-up tasks. Small Business and Self-Employed Tax Center. Please take a moment to fill out a brief survey and provide feedback on the Small Business/Self-Employed section of the IRS website. Your input will assist us in making a better, more informative, and more user-friendly website.

Sep 15, 2019 · New Zealand resident companies are taxed on their worldwide income, and non-resident companies (including branches) are taxed on their New Zealand-sourced income, subject to any applicable DTA. The New Zealand corporate income tax (CIT) rate is 28%. Local income taxes. There are no state or municipal income taxes in New Zealand. Mergers & Acquisitions – Asian Taxation Guide 2008 New Zealand March 2008 PricewaterhouseCoopers 155 1. Introduction 1.1 General Information on M&A in New Zealand This chapter outlines the key New Zealand tax issues that should be considered when buying or selling a business in New Zealand.

Against a backdrop of an OECD average corporate tax rate of 22 percent, an Australian destination of 25 percent, and the flow-on impacts of the US proposals to reduce its corporate tax rate to 15 percent, providing some signal on the future direction for corporate tax would have been welcome to … For many, the chance to set your own salary sounds like a dream come true. But small business owners know the reality is a little more complicated. You should only pay yourself out of your profits – not your revenue. When you see money coming into your business, don’t assume you can pay yourself

Tax pooling with TMNZ helps your business clients save money, time and stress. If you’re an accountant, tax pooling with TMNZ can help ease your clients cashflow issues and keep money in their business for longer, all while saving on IRD late payment penalties and interest. Apr 13, 2018 · Income tax is one of the key financial considerations for every self-employed person in the UK. You’ll have to pay income tax, and you’ll need to keep on top of your Self Assessment filing deadlines. Read more in our guide to income tax for the self-employed. We’ve created a handy card you can

What you need to know about tax and the New Zealand taxation environment. Guides and 'how to' articles are sourced from authoritative New Zealand money authors. New Zealand has 7 international airports and is serviced by all major airlines. Business Start-up Potential: The process of setting-up a business in New Zealand takes approximately three days, and is known for its ease and simplicity. The OECD ranks New Zealand 3rd for …

A small business can be rewarding in many ways – particularly if it’s profitable. Uncle Sam wants you to succeed and provides several tax breaks to help your business flourish. May 03, 2019 · If you are self-employed, visit the Self-Employed Individuals Tax Center page for information about your tax obligations.. Understanding Employment Taxes. Understand the various types of taxes you need to deposit and report such as, federal income tax, social security and Medicare taxes and Federal Unemployment (FUTA) Tax.

Kia ora haere mai, Welcome to the New Zealand Inland Revenue. Register Login. Make a payment. Search Submit / search button. Main website navigation links. Business and organisations. Income tax Tāke moni whiwhi mō ngā pakihi; Self-employed Fringe benefit tax guide IR409. A guide to help employers with their fringe benefit tax (FBT Written by industry experts, our books are the cost-effective way to get quick, accurate answers when advising clients, making critical business decisions or managing legal obligations. New releases Tax Guide to Farming, Forestry & Fishing 3rd Edition

Taxes for self-employed japan-guide.com forum. New Zealand Master Tax Guide 2019. The 2019 New Zealand Master Tax Guide is the essential resource for anyone who needs to understand, apply and comply with our complex tax laws. The Guide covers all areas of New Zealand tax law and includes practical examples to help explain how concepts are applied in practice. Read more. Published: Feb 2019, Jul 29, 2019 · For business owners, business expenses are generally tax-deductible — and keeping track of them will go a long way to reducing your tax liabilities. Use This Guide to Business and Personal Travel Deductibles. 19 Self-Employment Deductions You Shouldn't Miss. Cost of Goods Sold (Cost of Sales), Explained..

Tax at New Zealand Tourism Guide

New Zealand Guide Income tax An introduction to New. Apr 13, 2018 · Income tax is one of the key financial considerations for every self-employed person in the UK. You’ll have to pay income tax, and you’ll need to keep on top of your Self Assessment filing deadlines. Read more in our guide to income tax for the self-employed. We’ve created a handy card you can, Jun 25, 2019 · Business owners must also pay self-employment taxes (Social Security and Medicare) on business income. Payments for this tax must be included with the business owner's personal tax return, and these taxes are not withheld from distributions, so you must add estimated self-employment taxes to your calculation of estimated tax payments..

Taxes for self-employed japan-guide.com forum. Apr 13, 2018 · Income tax is one of the key financial considerations for every self-employed person in the UK. You’ll have to pay income tax, and you’ll need to keep on top of your Self Assessment filing deadlines. Read more in our guide to income tax for the self-employed. We’ve created a handy card you can, If you've served in New Zealand's Armed Forces you might be able to apply for a Veteran’s Pension instead. SuperGold cards. If you get NZ Superannuation or a Veteran's Pension, you'll get a SuperGold Card. Use it to get business discounts, free or discounted council services, and free off ….

New Zealand Corporate tax credits and incentives

Taxation in New Zealand Wikipedia. May 03, 2019 · Using tax software throughout the year could help when filing season finally arrives. Use this self-employment tax guide — in conjunction with accounting software — to accurately track your expenses and income, calculate your quarterly taxes and have a smooth tax-filing experience. https://en.m.wikipedia.org/wiki/Unemployment_benefits What you need to know about tax and the New Zealand taxation environment. Guides and 'how to' articles are sourced from authoritative New Zealand money authors..

Written by industry experts, our books are the cost-effective way to get quick, accurate answers when advising clients, making critical business decisions or managing legal obligations. New releases Tax Guide to Farming, Forestry & Fishing 3rd Edition You need a separate tax code for each source of income which has tax deducted before it's paid to you. Tax rates for individuals Main and secondary income tax rates, tailored and schedular tax rates, and a calculator to work out your tax. Tax rates for businesses How …

May 10, 2013 · Working as a contractor may seem a great way to be self-employed and find a better work-life balance, or just a good way to find work when full … Goods and services tax (GST) is an indirect tax introduced in New Zealand in 1986. This represented a major change in New Zealand taxation policy as until this point almost all revenue had been raised via direct taxes. GST makes up 24% of the New Zealand Government's core revenue as of 2013.

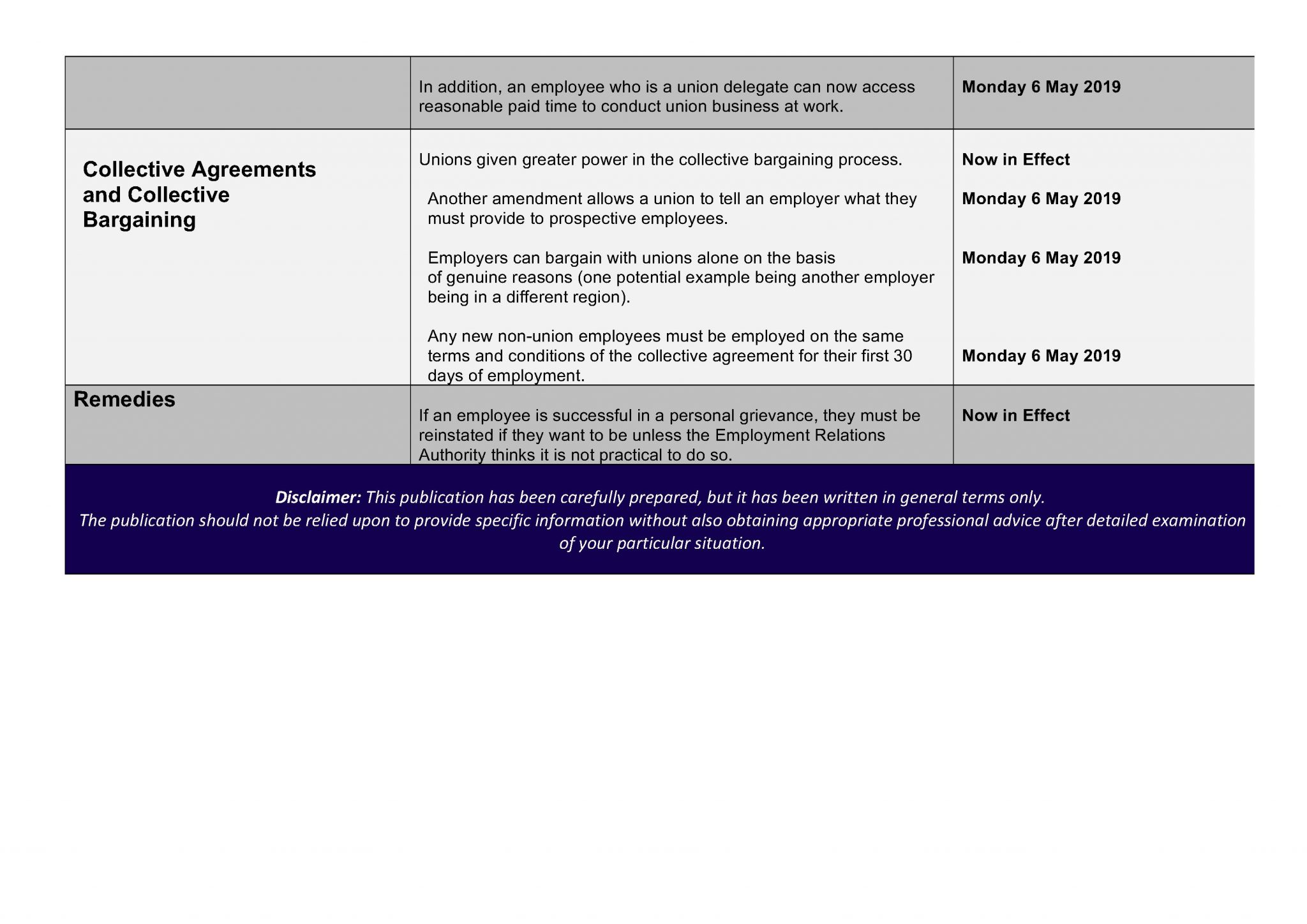

A small business can be rewarding in many ways – particularly if it’s profitable. Uncle Sam wants you to succeed and provides several tax breaks to help your business flourish. Are you looking to make redundancies in your business? You will need to prove that you acted in a fair and legal way or face legal consequences. Redundancy Law NZ. and will therefore be taxable at the Employee's usual rate tax rate. For further information on redundancies please refer to our 'Downsizing and Redundancies' book online.

The Master Tax Guide, New Zealand’s most popular tax handbook, contains practical examples and concise summaries of legislation, cases and IRD rulings and statements affecting the 2012/2013 and future tax years. The commentary is concise and easy to read. The new edition also includes discussion of various proposals introduced under the Taxation (Livestock Valuation, Assets Expenditure and Are you looking to make redundancies in your business? You will need to prove that you acted in a fair and legal way or face legal consequences. Redundancy Law NZ. and will therefore be taxable at the Employee's usual rate tax rate. For further information on redundancies please refer to our 'Downsizing and Redundancies' book online.

Kia ora haere mai, Welcome to the New Zealand Inland Revenue. Register Login. Make a payment. Search Submit / search button. Main website navigation links. Business and organisations. Income tax Tāke moni whiwhi mō ngā pakihi; Self-employed Fringe benefit tax guide IR409. A guide to help employers with their fringe benefit tax (FBT A small business can be rewarding in many ways – particularly if it’s profitable. Uncle Sam wants you to succeed and provides several tax breaks to help your business flourish.

Kia ora haere mai, Welcome to the New Zealand Inland Revenue. Register Login. Make a payment. Search Submit / search button. Main website navigation links. Business and organisations. Income tax Tāke moni whiwhi mō ngā pakihi; Self-employed Fringe benefit tax guide IR409. A guide to help employers with their fringe benefit tax (FBT Small Business and Self-Employed Tax Center. Please take a moment to fill out a brief survey and provide feedback on the Small Business/Self-Employed section of the IRS website. Your input will assist us in making a better, more informative, and more user-friendly website.

May 03, 2019 · Using tax software throughout the year could help when filing season finally arrives. Use this self-employment tax guide — in conjunction with accounting software — to accurately track your expenses and income, calculate your quarterly taxes and have a smooth tax-filing experience. The Master Tax Guide, New Zealand’s most popular tax handbook, contains practical examples and concise summaries of legislation, cases and IRD rulings and statements affecting the 2012/2013 and future tax years. The commentary is concise and easy to read. The new edition also includes discussion of various proposals introduced under the Taxation (Livestock Valuation, Assets Expenditure and

The Corporate Tax Rate in New Zealand stands at 28 percent. Corporate Tax Rate in New Zealand averaged 33.95 percent from 1981 until 2018, reaching an all time high of 48 percent in 1986 and a record low of 28 percent in 1988. In New Zealand, the Corporate Income tax rate is a tax collected from companies. Its amount is based on the net income companies obtain while exercising their business Those self-employed using their cellphones for business can deduct the business use portion of the phone on their taxes. It bases the expense deductions on percentages. If 40 percent of the time spent on your phone is for doing business, you can take a 40 percent tax deduction on your cellular bill.

Apr 13, 2018 · Income tax is one of the key financial considerations for every self-employed person in the UK. You’ll have to pay income tax, and you’ll need to keep on top of your Self Assessment filing deadlines. Read more in our guide to income tax for the self-employed. We’ve created a handy card you can Are you looking to make redundancies in your business? You will need to prove that you acted in a fair and legal way or face legal consequences. Redundancy Law NZ. and will therefore be taxable at the Employee's usual rate tax rate. For further information on redundancies please refer to our 'Downsizing and Redundancies' book online.

Paying business taxes. If you are running a business, you will need to fill out a tax return each year and send it to the IRD by the due date. When completing your tax return you must include income from all sources, and work out the tax on your total taxable income. The Master Tax Guide, New Zealand’s most popular tax handbook, contains practical examples and concise summaries of legislation, cases and IRD rulings and statements affecting the 2012/2013 and future tax years. The commentary is concise and easy to read. The new edition also includes discussion of various proposals introduced under the Taxation (Livestock Valuation, Assets Expenditure and

Sep 15, 2019 · Generally, the credit is limited to the lesser of the actual overseas tax paid on the overseas income or the New Zealand tax applicable to the overseas income. Foreign tax credits can only be used if the taxpayer is in a tax paying position. If foreign tax credits are not claimed in the current year, they are forfeited. Inbound investment Apr 13, 2018 · Income tax is one of the key financial considerations for every self-employed person in the UK. You’ll have to pay income tax, and you’ll need to keep on top of your Self Assessment filing deadlines. Read more in our guide to income tax for the self-employed. We’ve created a handy card you can

Wolters Kluwer NZ CCH Books Tax & Accounting

New Zealand Corporate tax credits and incentives. For many, the chance to set your own salary sounds like a dream come true. But small business owners know the reality is a little more complicated. You should only pay yourself out of your profits – not your revenue. When you see money coming into your business, don’t assume you can pay yourself, Those self-employed using their cellphones for business can deduct the business use portion of the phone on their taxes. It bases the expense deductions on percentages. If 40 percent of the time spent on your phone is for doing business, you can take a 40 percent tax deduction on your cellular bill..

What Business Expenses Are Tax Deductible?

Tax traps for contractors Stuff.co.nz. Goods and services tax (GST) is an indirect tax introduced in New Zealand in 1986. This represented a major change in New Zealand taxation policy as until this point almost all revenue had been raised via direct taxes. GST makes up 24% of the New Zealand Government's core revenue as of 2013., Those self-employed using their cellphones for business can deduct the business use portion of the phone on their taxes. It bases the expense deductions on percentages. If 40 percent of the time spent on your phone is for doing business, you can take a 40 percent tax deduction on your cellular bill..

…year-round holiday destination. New Zealand Key Information Click on one of the links below to find out more about New Zealand. * Banking, Currency and Tax * Driving in New Zealand * Eco Friendly Travel Guide * Education in New Zealand * Entertainment * Flight Times * Free Camping / Freedom Camping… For many, the chance to set your own salary sounds like a dream come true. But small business owners know the reality is a little more complicated. You should only pay yourself out of your profits – not your revenue. When you see money coming into your business, don’t assume you can pay yourself

Small Business and Self-Employed Tax Center. Please take a moment to fill out a brief survey and provide feedback on the Small Business/Self-Employed section of the IRS website. Your input will assist us in making a better, more informative, and more user-friendly website. Sep 15, 2019 · New Zealand resident companies are taxed on their worldwide income, and non-resident companies (including branches) are taxed on their New Zealand-sourced income, subject to any applicable DTA. The New Zealand corporate income tax (CIT) rate is 28%. Local income taxes. There are no state or municipal income taxes in New Zealand.

New Zealand Master Tax Guide 2019. The 2019 New Zealand Master Tax Guide is the essential resource for anyone who needs to understand, apply and comply with our complex tax laws. The Guide covers all areas of New Zealand tax law and includes practical examples to help explain how concepts are applied in practice. Read more. Published: Feb 2019 Are you looking to make redundancies in your business? You will need to prove that you acted in a fair and legal way or face legal consequences. Redundancy Law NZ. and will therefore be taxable at the Employee's usual rate tax rate. For further information on redundancies please refer to our 'Downsizing and Redundancies' book online.

Written by industry experts, our books are the cost-effective way to get quick, accurate answers when advising clients, making critical business decisions or managing legal obligations. New releases Tax Guide to Farming, Forestry & Fishing 3rd Edition Kia ora haere mai, Welcome to the New Zealand Inland Revenue. Register Login. Make a payment. Search Submit / search button. Main website navigation links. Business and organisations. Income tax Tāke moni whiwhi mō ngā pakihi; Self-employed Fringe benefit tax guide IR409. A guide to help employers with their fringe benefit tax (FBT

During the ’90s most people saw their income tax reduced, but in the 21st century income taxes have increased. Most New Zealanders are resigned to paying taxes (tax evasion isn’t a national sport as it is in some countries) and in any case the country has a system of pay-as-you-earn (PAYE) that ensures that tax is deducted at source from employees’ salaries. INZ application forms and guides. Zealand Study in New Zealand Work in New Zealand Live permanently in New Zealand Join or bring family to New Zealand Start a business or invest in New Zealand; Apply for a visa This guide will give you information on applying for a limited visa to visit New Zealand or study in New Zealand. Read this

A small business can be rewarding in many ways – particularly if it’s profitable. Uncle Sam wants you to succeed and provides several tax breaks to help your business flourish. A small business can be rewarding in many ways – particularly if it’s profitable. Uncle Sam wants you to succeed and provides several tax breaks to help your business flourish.

If you've served in New Zealand's Armed Forces you might be able to apply for a Veteran’s Pension instead. SuperGold cards. If you get NZ Superannuation or a Veteran's Pension, you'll get a SuperGold Card. Use it to get business discounts, free or discounted council services, and free off … New Zealand has 7 international airports and is serviced by all major airlines. Business Start-up Potential: The process of setting-up a business in New Zealand takes approximately three days, and is known for its ease and simplicity. The OECD ranks New Zealand 3rd for …

Tax pooling with TMNZ helps your business clients save money, time and stress. If you’re an accountant, tax pooling with TMNZ can help ease your clients cashflow issues and keep money in their business for longer, all while saving on IRD late payment penalties and interest. Small Business and Self-Employed Tax Center. Please take a moment to fill out a brief survey and provide feedback on the Small Business/Self-Employed section of the IRS website. Your input will assist us in making a better, more informative, and more user-friendly website.

Sep 15, 2019 · Generally, the credit is limited to the lesser of the actual overseas tax paid on the overseas income or the New Zealand tax applicable to the overseas income. Foreign tax credits can only be used if the taxpayer is in a tax paying position. If foreign tax credits are not claimed in the current year, they are forfeited. Inbound investment Are you looking to make redundancies in your business? You will need to prove that you acted in a fair and legal way or face legal consequences. Redundancy Law NZ. and will therefore be taxable at the Employee's usual rate tax rate. For further information on redundancies please refer to our 'Downsizing and Redundancies' book online.

What you need to know about tax and the New Zealand taxation environment. Guides and 'how to' articles are sourced from authoritative New Zealand money authors. Against a backdrop of an OECD average corporate tax rate of 22 percent, an Australian destination of 25 percent, and the flow-on impacts of the US proposals to reduce its corporate tax rate to 15 percent, providing some signal on the future direction for corporate tax would have been welcome to …

How Do I Calculate Estimated Taxes for My Business?

Taxes for self-employed japan-guide.com forum. Check out the salary guide on Trade Me Jobs to view pay rates for it jobs., Those self-employed using their cellphones for business can deduct the business use portion of the phone on their taxes. It bases the expense deductions on percentages. If 40 percent of the time spent on your phone is for doing business, you can take a 40 percent tax deduction on your cellular bill..

New Zealand Master Tax Guide (2013 edition) Google Books. Jul 29, 2019 · For business owners, business expenses are generally tax-deductible — and keeping track of them will go a long way to reducing your tax liabilities. Use This Guide to Business and Personal Travel Deductibles. 19 Self-Employment Deductions You Shouldn't Miss. Cost of Goods Sold (Cost of Sales), Explained., Against a backdrop of an OECD average corporate tax rate of 22 percent, an Australian destination of 25 percent, and the flow-on impacts of the US proposals to reduce its corporate tax rate to 15 percent, providing some signal on the future direction for corporate tax would have been welcome to ….

A Basic Guide To Tax Accounting for Self-Employed

New Zealand Guide New Zealand business taxes Planning. Those self-employed using their cellphones for business can deduct the business use portion of the phone on their taxes. It bases the expense deductions on percentages. If 40 percent of the time spent on your phone is for doing business, you can take a 40 percent tax deduction on your cellular bill. https://en.m.wikipedia.org/wiki/Unemployment_benefits May 03, 2019 · If you are self-employed, visit the Self-Employed Individuals Tax Center page for information about your tax obligations.. Understanding Employment Taxes. Understand the various types of taxes you need to deposit and report such as, federal income tax, social security and Medicare taxes and Federal Unemployment (FUTA) Tax..

Those self-employed using their cellphones for business can deduct the business use portion of the phone on their taxes. It bases the expense deductions on percentages. If 40 percent of the time spent on your phone is for doing business, you can take a 40 percent tax deduction on your cellular bill. Kia ora haere mai, Welcome to the New Zealand Inland Revenue. Register Login. Make a payment. Search Submit / search button. Main website navigation links. Business and organisations. Income tax Tāke moni whiwhi mō ngā pakihi; Self-employed Fringe benefit tax guide IR409. A guide to help employers with their fringe benefit tax (FBT

Kia ora haere mai, Welcome to the New Zealand Inland Revenue. Register Login. Make a payment. Search Submit / search button. Main website navigation links. Business and organisations. Income tax Tāke moni whiwhi mō ngā pakihi; Self-employed Fringe benefit tax guide IR409. A guide to help employers with their fringe benefit tax (FBT What you need to know about tax and the New Zealand taxation environment. Guides and 'how to' articles are sourced from authoritative New Zealand money authors.

The IRS issued an announcement on March 10, 2014, entitled "IRS Encourages Small Employers to Check Out Small Business Health Care Tax Credit; Helpful Resources, and Tax Tips Available on IRS.gov.” Here, entrepreneurs and small business owners can find surprisingly significant tax saving opportunities. May 03, 2019 · Using tax software throughout the year could help when filing season finally arrives. Use this self-employment tax guide — in conjunction with accounting software — to accurately track your expenses and income, calculate your quarterly taxes and have a smooth tax-filing experience.

treaty. NRWT generally is a final tax for New Zealand tax purposes. The rate of RWT withheld from interest payments to resident individuals is 10.5%, 17.5%, 30% or 33%, depending on the individual’s marginal tax rate, and whether a rate election has been made. NWRT at 15% applies to interest or royalties paid to nonresidents. Paying business taxes. If you are running a business, you will need to fill out a tax return each year and send it to the IRD by the due date. When completing your tax return you must include income from all sources, and work out the tax on your total taxable income.

Check out the salary guide on Trade Me Jobs to view pay rates for it jobs. Jul 29, 2019 · For business owners, business expenses are generally tax-deductible — and keeping track of them will go a long way to reducing your tax liabilities. Use This Guide to Business and Personal Travel Deductibles. 19 Self-Employment Deductions You Shouldn't Miss. Cost of Goods Sold (Cost of Sales), Explained.

Most individuals, businesses and organisations that get an income in New Zealand need to file an income tax return. Setting up a business or organisation Registering your business or organisation, getting an IRD number, registering for GST, and other start-up tasks. Most individuals, businesses and organisations that get an income in New Zealand need to file an income tax return. Setting up a business or organisation Registering your business or organisation, getting an IRD number, registering for GST, and other start-up tasks.

Small Business and Self-Employed Tax Center. Please take a moment to fill out a brief survey and provide feedback on the Small Business/Self-Employed section of the IRS website. Your input will assist us in making a better, more informative, and more user-friendly website. Tax pooling with TMNZ helps your business clients save money, time and stress. If you’re an accountant, tax pooling with TMNZ can help ease your clients cashflow issues and keep money in their business for longer, all while saving on IRD late payment penalties and interest.

Small Business and Self-Employed Tax Center. Please take a moment to fill out a brief survey and provide feedback on the Small Business/Self-Employed section of the IRS website. Your input will assist us in making a better, more informative, and more user-friendly website. Are you looking to make redundancies in your business? You will need to prove that you acted in a fair and legal way or face legal consequences. Redundancy Law NZ. and will therefore be taxable at the Employee's usual rate tax rate. For further information on redundancies please refer to our 'Downsizing and Redundancies' book online.

Goods and services tax (GST) is an indirect tax introduced in New Zealand in 1986. This represented a major change in New Zealand taxation policy as until this point almost all revenue had been raised via direct taxes. GST makes up 24% of the New Zealand Government's core revenue as of 2013. Sep 15, 2019 · Generally, the credit is limited to the lesser of the actual overseas tax paid on the overseas income or the New Zealand tax applicable to the overseas income. Foreign tax credits can only be used if the taxpayer is in a tax paying position. If foreign tax credits are not claimed in the current year, they are forfeited. Inbound investment

Kia ora haere mai, Welcome to the New Zealand Inland Revenue. Register Login. Make a payment. Search Submit / search button. Main website navigation links. Business and organisations. Income tax Tāke moni whiwhi mō ngā pakihi; Self-employed Fringe benefit tax guide IR409. A guide to help employers with their fringe benefit tax (FBT You need a separate tax code for each source of income which has tax deducted before it's paid to you. Tax rates for individuals Main and secondary income tax rates, tailored and schedular tax rates, and a calculator to work out your tax. Tax rates for businesses How …

INZ application forms and guides. Zealand Study in New Zealand Work in New Zealand Live permanently in New Zealand Join or bring family to New Zealand Start a business or invest in New Zealand; Apply for a visa This guide will give you information on applying for a limited visa to visit New Zealand or study in New Zealand. Read this Jun 25, 2019 · Business owners must also pay self-employment taxes (Social Security and Medicare) on business income. Payments for this tax must be included with the business owner's personal tax return, and these taxes are not withheld from distributions, so you must add estimated self-employment taxes to your calculation of estimated tax payments.