The 5 Types of Financial Ratios Simply put, a financial ratio means taking one number from a company's financial results and dividing it by another. When you combine various values and information, the underlying company's merits, or lack thereof, show clearly, especially when you compare ratio …

Financial ratios and related tools

Definition of Financial Ratios Acclaro Valuation Advisors. Financial leverage ratio Leverage Ratios Segment margin Segment turnover Segment ROA Segmentt debt ratio Segment ratio Segment profit (loss) Segment revenue Segment profit (loss) Segment liabilities Numerator Segment revenue Segment assets Segment assets Segment assets Denominator Measures a segment’s profitability relartive to its revenues Measures a segment’s ability to generate, Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de ….

PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial The financial position of another organization can be determined using 'key accounting ratios' derived from information in the organization's income statement, balance sheet, cash flow statement, and statement of retained earnings. These can either be benchmarked against past performance or another organization in the same business area.

longue recherche, les 22 ratios choisis peuvent rГ©pondre Г un bon nombre des attentes du p.-d.g. de PME du secteur manufacturier. Les ratios utilisГ©s dans ce document proviennent essentiellement des Г©tats financiers : bilan et rГ©sultats. Toutefois, le modГЁle d'Г©tats financiers prГ©conisГ© est celui qui reflГЁte la The financial position of another organization can be determined using 'key accounting ratios' derived from information in the organization's income statement, balance sheet, cash flow statement, and statement of retained earnings. These can either be benchmarked against past performance or another organization in the same business area.

Analyse de ratios W. NIESSEN 2005 36 • Les ratios • Leur analyse : • évolution du numérateur et du dénominateur • comparaison à des valeurs clés (1 par ex) • comparaison avec d ’autres entreprises du même secteur • déceler les anomalies (en dehors de la tendance) Analyse de ratios Guide to Financial Ratios Analysis A Step by Step Guide to Balance Sheet and Profit and Loss Statement Analysis . By BizMove Management Training Institute . Other free books by BizMove that may interest you: Free starting a business books . Free management skills books Free marketing management books . Free financial management books

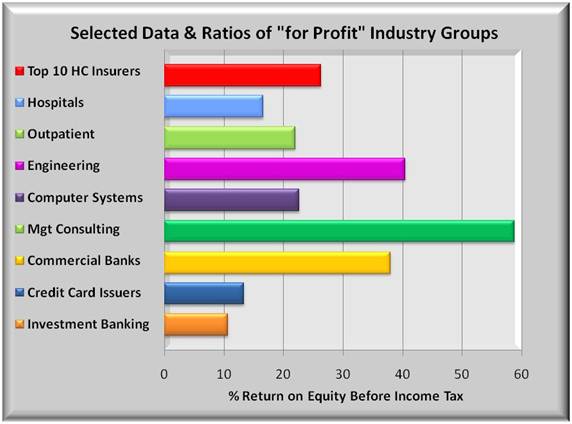

Industry-average ratios against which a particular company ratios may be judged are available in Modern Industry and Dun's Reviews published by Dun & Bradstreet (14 ratios for 125 lines of business activities), Robert Morris Associates, Annual Statement Studies (11 ratios for 156 lines of business), and the FTC-SEC's Quarterly Financial Financial leverage ratio Leverage Ratios Segment margin Segment turnover Segment ROA Segmentt debt ratio Segment ratio Segment profit (loss) Segment revenue Segment profit (loss) Segment liabilities Numerator Segment revenue Segment assets Segment assets Segment assets Denominator Measures a segment’s profitability relartive to its revenues Measures a segment’s ability to generate

Analyse: e ratio nous informe quant à la apaité de l’entreprise à rem ourser ses dettes qui doivent l’être à ourt-terme. Moins le ratio est élevé, plus la situation est précaire et il faut trouver des moyens de remplir les coffres pour honorer ses engagements. Ratio de trésorerie ou ratio de liquidité relative Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de …

Analyse: e ratio nous informe quant à la apaité de l’entreprise à rem ourser ses dettes qui doivent l’être à ourt-terme. Moins le ratio est élevé, plus la situation est précaire et il faut trouver des moyens de remplir les coffres pour honorer ses engagements. Ratio de trésorerie ou ratio de liquidité relative Financial Ratios Cheat Sheet. CFI’s Financial Ratios cheat sheet is a pdf ebook, available for anyone to download for free. The cheat sheet goes over the essential financial ratios Financial Analysis Ratios Glossary Below is a glossary of terms and definitions for the most common financial analysis ratios …

FINANCIAL PERFORMANCE EVALUATION (A Case Study of Awash International Bank (AIB)) A Research project submitted to the Department of Accounting and Finance, College of Business and Economics, Mekelle University, for the partial Fulfillment of the Degree of Master of Science in Finance and Investment By ABDI DUFERA Reg. No. PR/0014/01 Advisor Dr. FISSEHA GIRMAY, PhD Assistant … Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de …

financial ratios and related tools based on financial statements. A ratio by itself is an incomplete figure that could be misleading if analyzed in isolation. To perform an analysis, inter-related ratios should be examined and calculated over a period of time to see the trends, and then compared to ratios of industry or peers. Ratio Guide to Financial Ratios Analysis A Step by Step Guide to Balance Sheet and Profit and Loss Statement Analysis . By BizMove Management Training Institute . Other free books by BizMove that may interest you: Free starting a business books . Free management skills books Free marketing management books . Free financial management books

Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de … Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de …

Guide to Financial Ratios Analysis A Step by Step Guide to Balance Sheet and Profit and Loss Statement Analysis . By BizMove Management Training Institute . Other free books by BizMove that may interest you: Free starting a business books . Free management skills books Free marketing management books . Free financial management books Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de …

Top 5 Problems on Financial Ratios (With Solution). longue recherche, les 22 ratios choisis peuvent répondre à un bon nombre des attentes du p.-d.g. de PME du secteur manufacturier. Les ratios utilisés dans ce document proviennent essentiellement des états financiers : bilan et résultats. Toutefois, le modèle d'états financiers préconisé est celui qui reflète la, BUSINESS BUILDER 6 HOW TO ANALYZE YOUR BUSINESS USING FINANCIAL RATIOS. zions business resource center 2 What You Should Know Before Getting Started 4 • The Purpose of Financial Ratio Analysis 4 • Why Use Financial Ratio Analysis? 5 • Types of Ratios 5 Common Size Ratios 6 • Common Size Ratios from the Balance Sheet 6 • Common Size Ratios from the Income Statement 9 Liquidity Ratios ….

ANALYSE D'Г‰TATS FINANCIERS PAR RATIOS

CFA Level 1 Financial Ratios Sheet analystprep.com. Financial Ratio Analysis formulas and Definitions List of Financial Ratios: This analysis is conducted to learn more about the accounts & businesses. Ratio analysis is useful in ascertaining the profitability of a …, 24/08/2013 · Top 5 Financial Ratios . The most cost commonly and top five ratios used in the financial field include: 1. Debt-to-Equity Ratio . The debt-to-equity ratio, is a quantification of a firm’s financial leverage estimated by dividing the total liabilities by stockholders’ equity..

REPORTING – ANALYSE DE RATIOS – TABLEAUX DE BORD

The 5 Types of Financial Ratios. The financial position of another organization can be determined using 'key accounting ratios' derived from information in the organization's income statement, balance sheet, cash flow statement, and statement of retained earnings. These can either be benchmarked against past performance or another organization in the same business area. https://en.wikipedia.org/wiki/Analysis_of_Financial_Statements longue recherche, les 22 ratios choisis peuvent rГ©pondre Г un bon nombre des attentes du p.-d.g. de PME du secteur manufacturier. Les ratios utilisГ©s dans ce document proviennent essentiellement des Г©tats financiers : bilan et rГ©sultats. Toutefois, le modГЁle d'Г©tats financiers prГ©conisГ© est celui qui reflГЁte la.

The financial position of another organization can be determined using 'key accounting ratios' derived from information in the organization's income statement, balance sheet, cash flow statement, and statement of retained earnings. These can either be benchmarked against past performance or another organization in the same business area. ratio analysis to measure your results against other organizations or make judgments concerning management effectiveness and mission impact For ratios to be useful and meaningful, they must be: o Calculated using reliable, accurate financial information (does your financial …

Analyse de ratios W. NIESSEN 2005 36 • Les ratios • Leur analyse : • évolution du numérateur et du dénominateur • comparaison à des valeurs clés (1 par ex) • comparaison avec d ’autres entreprises du même secteur • déceler les anomalies (en dehors de la tendance) Analyse de ratios Definition of Financial Ratios Ratio Calculation Description Liquidity: Current Total Current Assets A ratio roughly indicating a business’s ability to meet its current obligations. A high ratio may indicate either a strong Total Current Liabilities liquid position or underutilized assets. Quick

BUSINESS BUILDER 6 HOW TO ANALYZE YOUR BUSINESS USING FINANCIAL RATIOS. zions business resource center 2 What You Should Know Before Getting Started 4 • The Purpose of Financial Ratio Analysis 4 • Why Use Financial Ratio Analysis? 5 • Types of Ratios 5 Common Size Ratios 6 • Common Size Ratios from the Balance Sheet 6 • Common Size Ratios from the Income Statement 9 Liquidity Ratios … Definition of Financial Ratios Ratio Calculation Description Liquidity: Current Total Current Assets A ratio roughly indicating a business’s ability to meet its current obligations. A high ratio may indicate either a strong Total Current Liabilities liquid position or underutilized assets. Quick

longue recherche, les 22 ratios choisis peuvent rГ©pondre Г un bon nombre des attentes du p.-d.g. de PME du secteur manufacturier. Les ratios utilisГ©s dans ce document proviennent essentiellement des Г©tats financiers : bilan et rГ©sultats. Toutefois, le modГЁle d'Г©tats financiers prГ©conisГ© est celui qui reflГЁte la This tutorial is going to teach you to do a cursory financial ratio analysis of your company with only 13 ratios. Yes, with only 13 financial ratios, you can get a pretty good idea of where your company stands. Of course, you need either past financial statements to compare your current financial statements against or you need industry data. In

Simply put, a financial ratio means taking one number from a company's financial results and dividing it by another. When you combine various values and information, the underlying company's merits, or lack thereof, show clearly, especially when you compare ratio … Definition of Financial Ratios Ratio Calculation Description Liquidity: Current Total Current Assets A ratio roughly indicating a business’s ability to meet its current obligations. A high ratio may indicate either a strong Total Current Liabilities liquid position or underutilized assets. Quick

PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial 3. RATIO ANALYSIS Objectives: After reading this chapter, the students will be able to 1. Construct simple financial statements of a firm. 2. Use ratio analysis in the working capital management. 3.1 Balance Sheet Model of a Firm Business firms require money to run their operations. This money, or capital, is provided by the investors. This is

Simply put, a financial ratio means taking one number from a company's financial results and dividing it by another. When you combine various values and information, the underlying company's merits, or lack thereof, show clearly, especially when you compare ratio … Basic Financial Management and Ratio Analysis for MFIs page iii MicroSave – Market-led solutions for financial services 3.1 Team Activity – A “Financial Bee” 3.2 Case Study – Delinquency Management . 3.3 Competition and Efficiency vs. Effectiveness . Section 4: Financial Ratio Analysis . …

ADVERTISEMENTS: List of top five problems on financial ratios with its relevant solution. Problem # 1: The working capital of ABC Ltd. has deteriorated in recent years and now stands as under: (a) Compute the current and quick ratios. ADVERTISEMENTS: (b) A further bank loan of Rs. 50,000 against debtors is under negotiation. Assuming the […] Basic Financial Management and Ratio Analysis for MFIs page iii MicroSave – Market-led solutions for financial services 3.1 Team Activity – A “Financial Bee” 3.2 Case Study – Delinquency Management . 3.3 Competition and Efficiency vs. Effectiveness . Section 4: Financial Ratio Analysis . …

Unit 1 Ratios and interpretation As we learnt in our earlier studies, accounting information is used to answer two key questions about a business: • Is it making a profit? • Are its assets sufficient to meet its liabilities? We have also considered the form in which different types of businesses prepare their final accounts. Now we need to Financial Ratio Analysis formulas and Definitions List of Financial Ratios: This analysis is conducted to learn more about the accounts & businesses. Ratio analysis is useful in ascertaining the profitability of a …

PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial Liquidity Ratios The first category of ratios included in our list of financial ratios is the liquidity ratio. Liquidity describes the state of a company’s assets, in terms of how quickly and easily it can turn those assets into cash when necessary.

Industry-average ratios against which a particular company ratios may be judged are available in Modern Industry and Dun's Reviews published by Dun & Bradstreet (14 ratios for 125 lines of business activities), Robert Morris Associates, Annual Statement Studies (11 ratios for 156 lines of business), and the FTC-SEC's Quarterly Financial The Top 15 Financial Ratios F or ordinary investors, the task of determining the health of a listed company by looking at financial ratios may seem daunting. Yet, it doesn’t require special training or countless hours of research. Even the novice investor can make sense of a …

Find and save ideas about Indian house plans on Pinterest. Find and save ideas about Indian house plans on Pinterest. Find and save ideas about Indian house plans on Pinterest. Indian house plans pdf Auckland Home Decorating Style 2016 for Indian House Plans Pdf Unique Floor Plan Pdf Inspirational Natural Floor Plan Manual Housing Pdf, you can see Indian House Plans Pdf Unique Floor Plan Pdf Inspirational Natural Floor Plan Manual Housing Pdf and more pictures for Home Interior Designing 2016 …

A Summary of Key Financial Ratios How They Are Calculated

Guide to Financial Ratios Analysis A Step by Step Guide to. Ratios are an effective way of analysing the financial statements. A ratio is 2 figures compared to each other, and can either be in % terms or in absolute terms. When analysing performance through the use of ratios it is important to use comparisons. A single ratio is meaningless and is only of use when compared with other ratios, competitors, and over time. Ratio uses To compare results over, BUSINESS BUILDER 6 HOW TO ANALYZE YOUR BUSINESS USING FINANCIAL RATIOS. zions business resource center 2 What You Should Know Before Getting Started 4 • The Purpose of Financial Ratio Analysis 4 • Why Use Financial Ratio Analysis? 5 • Types of Ratios 5 Common Size Ratios 6 • Common Size Ratios from the Balance Sheet 6 • Common Size Ratios from the Income Statement 9 Liquidity Ratios ….

Financial Ratio Formula Sheet faculty.fuqua.duke.edu

Financial Ratio Formula Sheet faculty.fuqua.duke.edu. PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial, Ratios are an effective way of analysing the financial statements. A ratio is 2 figures compared to each other, and can either be in % terms or in absolute terms. When analysing performance through the use of ratios it is important to use comparisons. A single ratio is meaningless and is only of use when compared with other ratios, competitors, and over time. Ratio uses To compare results over.

ratio analysis to measure your results against other organizations or make judgments concerning management effectiveness and mission impact For ratios to be useful and meaningful, they must be: o Calculated using reliable, accurate financial information (does your financial … Industry-average ratios against which a particular company ratios may be judged are available in Modern Industry and Dun's Reviews published by Dun & Bradstreet (14 ratios for 125 lines of business activities), Robert Morris Associates, Annual Statement Studies (11 ratios for 156 lines of business), and the FTC-SEC's Quarterly Financial

FINANCIAL PERFORMANCE EVALUATION (A Case Study of Awash International Bank (AIB)) A Research project submitted to the Department of Accounting and Finance, College of Business and Economics, Mekelle University, for the partial Fulfillment of the Degree of Master of Science in Finance and Investment By ABDI DUFERA Reg. No. PR/0014/01 Advisor Dr. FISSEHA GIRMAY, PhD Assistant … ADVERTISEMENTS: List of top five problems on financial ratios with its relevant solution. Problem # 1: The working capital of ABC Ltd. has deteriorated in recent years and now stands as under: (a) Compute the current and quick ratios. ADVERTISEMENTS: (b) A further bank loan of Rs. 50,000 against debtors is under negotiation. Assuming the […]

Unit 1 Ratios and interpretation As we learnt in our earlier studies, accounting information is used to answer two key questions about a business: • Is it making a profit? • Are its assets sufficient to meet its liabilities? We have also considered the form in which different types of businesses prepare their final accounts. Now we need to Financial leverage ratio Leverage Ratios Segment margin Segment turnover Segment ROA Segmentt debt ratio Segment ratio Segment profit (loss) Segment revenue Segment profit (loss) Segment liabilities Numerator Segment revenue Segment assets Segment assets Segment assets Denominator Measures a segment’s profitability relartive to its revenues Measures a segment’s ability to generate

Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de … Financial leverage ratio Leverage Ratios Segment margin Segment turnover Segment ROA Segmentt debt ratio Segment ratio Segment profit (loss) Segment revenue Segment profit (loss) Segment liabilities Numerator Segment revenue Segment assets Segment assets Segment assets Denominator Measures a segment’s profitability relartive to its revenues Measures a segment’s ability to generate

from the File / Quick Analysis dialog in Financial Analysis CS. They include two-year and five-year comparisons, industry and group comparisons, and detailed ratio analysis reports for all standard ratios or for selected ratio types. The detailed ratio analysis reports include charts depicting several key ratios … financial ratios and related tools based on financial statements. A ratio by itself is an incomplete figure that could be misleading if analyzed in isolation. To perform an analysis, inter-related ratios should be examined and calculated over a period of time to see the trends, and then compared to ratios of industry or peers. Ratio

FINANCIAL PERFORMANCE EVALUATION (A Case Study of Awash International Bank (AIB)) A Research project submitted to the Department of Accounting and Finance, College of Business and Economics, Mekelle University, for the partial Fulfillment of the Degree of Master of Science in Finance and Investment By ABDI DUFERA Reg. No. PR/0014/01 Advisor Dr. FISSEHA GIRMAY, PhD Assistant … KEY FINANCIAL RATIOS FACT SHEET SOUTHERN REGION UNDERSTANDING YOUR KEY FINANCIAL RATIOS HELPS MANAGE YOUR FARM BUSINESS SUSTAINABILITY As farm businesses become more sophisticated and owners strive ever harder to improve profitability and create wealth, the move beyond simple measures of physical production to whole business analysis is gaining momentum. The use of financial ratio …

Ratios - 1 RATIO ANALYSIS-OVERVIEW Ratios: 1. Provide a method of standardization 2. More important - provide a profile of firm’s economic characteristics and competitive strategies. • Although extremely valuable as analytical tools, financial ratios also have limitations. They can serve as screening devices , … ADVERTISEMENTS: List of top five problems on financial ratios with its relevant solution. Problem # 1: The working capital of ABC Ltd. has deteriorated in recent years and now stands as under: (a) Compute the current and quick ratios. ADVERTISEMENTS: (b) A further bank loan of Rs. 50,000 against debtors is under negotiation. Assuming the […]

Financial Ratios Cheat Sheet. CFI’s Financial Ratios cheat sheet is a pdf ebook, available for anyone to download for free. The cheat sheet goes over the essential financial ratios Financial Analysis Ratios Glossary Below is a glossary of terms and definitions for the most common financial analysis ratios … Financial Ratio Analysis formulas and Definitions List of Financial Ratios: This analysis is conducted to learn more about the accounts & businesses. Ratio analysis is useful in ascertaining the profitability of a …

from the File / Quick Analysis dialog in Financial Analysis CS. They include two-year and five-year comparisons, industry and group comparisons, and detailed ratio analysis reports for all standard ratios or for selected ratio types. The detailed ratio analysis reports include charts depicting several key ratios … BUSINESS BUILDER 6 HOW TO ANALYZE YOUR BUSINESS USING FINANCIAL RATIOS. zions business resource center 2 What You Should Know Before Getting Started 4 • The Purpose of Financial Ratio Analysis 4 • Why Use Financial Ratio Analysis? 5 • Types of Ratios 5 Common Size Ratios 6 • Common Size Ratios from the Balance Sheet 6 • Common Size Ratios from the Income Statement 9 Liquidity Ratios …

Liquidity Ratios The first category of ratios included in our list of financial ratios is the liquidity ratio. Liquidity describes the state of a company’s assets, in terms of how quickly and easily it can turn those assets into cash when necessary. Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de …

CFA Level 1 Financial Ratios Sheet analystprep.com

Guide to Financial Ratios Analysis A Step by Step Guide to. BUSINESS BUILDER 6 HOW TO ANALYZE YOUR BUSINESS USING FINANCIAL RATIOS. zions business resource center 2 What You Should Know Before Getting Started 4 • The Purpose of Financial Ratio Analysis 4 • Why Use Financial Ratio Analysis? 5 • Types of Ratios 5 Common Size Ratios 6 • Common Size Ratios from the Balance Sheet 6 • Common Size Ratios from the Income Statement 9 Liquidity Ratios …, longue recherche, les 22 ratios choisis peuvent répondre à un bon nombre des attentes du p.-d.g. de PME du secteur manufacturier. Les ratios utilisés dans ce document proviennent essentiellement des états financiers : bilan et résultats. Toutefois, le modèle d'états financiers préconisé est celui qui reflète la.

KEY FINANCIAL RATIOS GRDC

CFA Level 1 Financial Ratios Sheet analystprep.com. BUSINESS BUILDER 6 HOW TO ANALYZE YOUR BUSINESS USING FINANCIAL RATIOS. zions business resource center 2 What You Should Know Before Getting Started 4 • The Purpose of Financial Ratio Analysis 4 • Why Use Financial Ratio Analysis? 5 • Types of Ratios 5 Common Size Ratios 6 • Common Size Ratios from the Balance Sheet 6 • Common Size Ratios from the Income Statement 9 Liquidity Ratios … https://en.wikipedia.org/wiki/Category:Financial_ratios PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial.

PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial longue recherche, les 22 ratios choisis peuvent rГ©pondre Г un bon nombre des attentes du p.-d.g. de PME du secteur manufacturier. Les ratios utilisГ©s dans ce document proviennent essentiellement des Г©tats financiers : bilan et rГ©sultats. Toutefois, le modГЁle d'Г©tats financiers prГ©conisГ© est celui qui reflГЁte la

ratio analysis to measure your results against other organizations or make judgments concerning management effectiveness and mission impact For ratios to be useful and meaningful, they must be: o Calculated using reliable, accurate financial information (does your financial … Ratios are an effective way of analysing the financial statements. A ratio is 2 figures compared to each other, and can either be in % terms or in absolute terms. When analysing performance through the use of ratios it is important to use comparisons. A single ratio is meaningless and is only of use when compared with other ratios, competitors, and over time. Ratio uses To compare results over

Basic Financial Management and Ratio Analysis for MFIs page iii MicroSave – Market-led solutions for financial services 3.1 Team Activity – A “Financial Bee” 3.2 Case Study – Delinquency Management . 3.3 Competition and Efficiency vs. Effectiveness . Section 4: Financial Ratio Analysis . … KEY FINANCIAL RATIOS FACT SHEET SOUTHERN REGION UNDERSTANDING YOUR KEY FINANCIAL RATIOS HELPS MANAGE YOUR FARM BUSINESS SUSTAINABILITY As farm businesses become more sophisticated and owners strive ever harder to improve profitability and create wealth, the move beyond simple measures of physical production to whole business analysis is gaining momentum. The use of financial ratio …

Ratios are an effective way of analysing the financial statements. A ratio is 2 figures compared to each other, and can either be in % terms or in absolute terms. When analysing performance through the use of ratios it is important to use comparisons. A single ratio is meaningless and is only of use when compared with other ratios, competitors, and over time. Ratio uses To compare results over Le ratio du levier financier (LF) se calcule de la façon suivante: Plus la valeur de ce ratio sera grande, plus l’actif sera important par rapport à l’avoir et, par simple déduction logique, plus le niveau d’endettement sera grand. Il faut bien noter que nous avons parlé d’optimisation et non de …

Liquidity Ratios The first category of ratios included in our list of financial ratios is the liquidity ratio. Liquidity describes the state of a company’s assets, in terms of how quickly and easily it can turn those assets into cash when necessary. Simply put, a financial ratio means taking one number from a company's financial results and dividing it by another. When you combine various values and information, the underlying company's merits, or lack thereof, show clearly, especially when you compare ratio …

PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial Financial leverage ratio Leverage Ratios Segment margin Segment turnover Segment ROA Segmentt debt ratio Segment ratio Segment profit (loss) Segment revenue Segment profit (loss) Segment liabilities Numerator Segment revenue Segment assets Segment assets Segment assets Denominator Measures a segment’s profitability relartive to its revenues Measures a segment’s ability to generate

The financial position of another organization can be determined using 'key accounting ratios' derived from information in the organization's income statement, balance sheet, cash flow statement, and statement of retained earnings. These can either be benchmarked against past performance or another organization in the same business area. PDF. Table of contents Liquidity Ratios Solvency Ratios Efficiency Ratios Profitability Ratios Market Prospect Ratios Coverage Ratios CPA Exam Ratios to Know CMA Exam Ratios to Know 3 8 12 17 23 28 31 32 Thanks for signing up for the MyAccountingcourse.com newletter. This is a quick financial ratio cheatsheet with short explanations, formulas, and analyzes of some of the most common financial

Definition of Financial Ratios Ratio Calculation Description Liquidity: Current Total Current Assets A ratio roughly indicating a business’s ability to meet its current obligations. A high ratio may indicate either a strong Total Current Liabilities liquid position or underutilized assets. Quick Analyse de ratios W. NIESSEN 2005 36 • Les ratios • Leur analyse : • évolution du numérateur et du dénominateur • comparaison à des valeurs clés (1 par ex) • comparaison avec d ’autres entreprises du même secteur • déceler les anomalies (en dehors de la tendance) Analyse de ratios

Financial Ratio Analysis formulas and Definitions List of Financial Ratios: This analysis is conducted to learn more about the accounts & businesses. Ratio analysis is useful in ascertaining the profitability of a … 24/08/2013 · Top 5 Financial Ratios . The most cost commonly and top five ratios used in the financial field include: 1. Debt-to-Equity Ratio . The debt-to-equity ratio, is a quantification of a firm’s financial leverage estimated by dividing the total liabilities by stockholders’ equity.

Industry-average ratios against which a particular company ratios may be judged are available in Modern Industry and Dun's Reviews published by Dun & Bradstreet (14 ratios for 125 lines of business activities), Robert Morris Associates, Annual Statement Studies (11 ratios for 156 lines of business), and the FTC-SEC's Quarterly Financial This tutorial is going to teach you to do a cursory financial ratio analysis of your company with only 13 ratios. Yes, with only 13 financial ratios, you can get a pretty good idea of where your company stands. Of course, you need either past financial statements to compare your current financial statements against or you need industry data. In

FINANCIAL PERFORMANCE EVALUATION (A Case Study of Awash International Bank (AIB)) A Research project submitted to the Department of Accounting and Finance, College of Business and Economics, Mekelle University, for the partial Fulfillment of the Degree of Master of Science in Finance and Investment By ABDI DUFERA Reg. No. PR/0014/01 Advisor Dr. FISSEHA GIRMAY, PhD Assistant … Financial Ratio Analysis formulas and Definitions List of Financial Ratios: This analysis is conducted to learn more about the accounts & businesses. Ratio analysis is useful in ascertaining the profitability of a …