First year of trading and provisional tax Tax Management Dec 07, 2015 · The disclosure changes (which do not apply when the party is dealing with their “main home”) require parties to a property transaction to provide their IRD numbers and, where applicable, their taxpayer identification number from any overseas countries where they have to pay tax on their worldwide income.

First year of trading and provisional tax Tax Management

Publication 541 (02/2019) Partnerships Internal Revenue. Entertainment Tax Return Guide - 2019 Inland Revenue Department – Government of Antigua and Barbuda 4 January 2019 Before You Start 1. Who has to file an Entertainment Tax Return? Please note that this Guide is not a substitute for the Act or its Regulations …, In relation to information a Māori authority receives from its customers, for example, name, contact details, date of birth, IRD number and tax rate, they are only expected to pass on the information provided to them. Officials recommend that this is clarified in the Tax Information Bulletin..

Feb 01, 2019 · Car expenses and benefits Log — Annual Summary (2019 Car expenses and benefits log — Annual summary) For help For assistance with this complex subject, contact your PwC adviser or any of the individuals listed on page 25 of the car tax guide. Important download instructions for files Publication 15-B (2019), Employer's Tax Guide to Fringe Benefits English; Publication 15-B - Introductory Material Armed Forces' Tax Guide, Treat a 2% shareholder as you would a partner in a partnership for fringe benefit purposes, but don't treat the benefit as a reduction in distributions to the 2% shareholder.

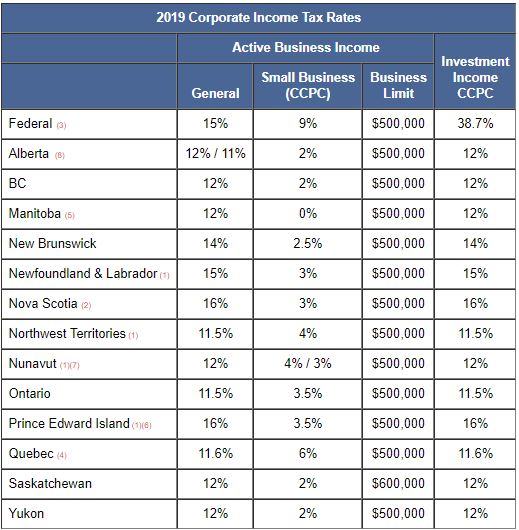

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . INLAND REVENUE DEPARTMENT . THE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION . A BRIEF GUIDE TO TAXES . ADMINISTERED BY THE . partnership in respect of his liability to pay such contributions as a Welcome to the fourth annual Mazars Central and Eastern European (CEE) tax guide, and once again it focuses on the changes in the tax systems of the region. During our review, we have observed big variations in tax strategies across the countries: some increased their consumption taxes, others introduced income tax hikes, and we also witnessed novel solutions such as sectoral crisis taxes, the

INCOME TAX [CAP. 123. 1 CHAPTER 123 INCOME TAX ACT To impose a Tax upon Incomes. Amended by: XVI of 2017., VII of 2018.and VII of 2019 ARRANGEMENT OF ACT Articles Part I. Preliminary 1-3 Part II. Imposition of Income Tax 4-11 Part III. Exemptions 12-13 Part IV. Deductions 14-26 partnership none of the partners is an individual who is Introduction. Salaries Tax, Profits Tax and Property Tax are the only 3 income taxes imposed in Hong Kong. This section focus on only the Profits Tax involved when an individual, a partnership and an body incorporate (i.e. company) carrying on business in Hong Kong, for the other fee and duty involved, we are going to talk about it here.

Oct 31, 2016 · Get an IRD number / Get an IRD number for a business, charity or trust Get an IRD number for a business, charity or trust. If you’re setting up a new business, you’ll need an IRD number for the business if it's a company, partnership, or a trust or estate. If you’re a sole trader, you can use your own IRD number for your business Tax. A general partnership doesn’t pay income tax, it distributes the partnership’s income to the partners who pay tax under their own IRD numbers. Each partner pays tax according to how much of the partnership they own — their shareholding. The bigger the shareholding, the …

Entertainment Tax Return Guide - 2019 Inland Revenue Department – Government of Antigua and Barbuda 4 January 2019 Before You Start 1. Who has to file an Entertainment Tax Return? Please note that this Guide is not a substitute for the Act or its Regulations … Apply the 3.8% Medicare tax to partnership distributions. Determine the tax effect of distributions of marketable stock and securities. Report distributions on Form 1065. Identify income in respect of a decedent (IRD), the types of IRD items, and the effect of a §754 election. Explain the self-employment tax problems that result from

Apply the 3.8% Medicare tax to partnership distributions. Determine the tax effect of distributions of marketable stock and securities. Report distributions on Form 1065. Identify income in respect of a decedent (IRD), the types of IRD items, and the effect of a В§754 election. Explain the self-employment tax problems that result from 11/05/2019 Publ 225: Farmer's Tax Guide 2019 11/05/2019 Form 8453-I: Foreign Corporation Income Tax Declaration for an IRS e-file Return 2019 11/04/2019 Publ 6187: Calendar Year Projections of Individual Returns by Major Processing Categories 1019 11/04/2019

When Do I Need To File an IR3 / Tax Return. There are several reasons why you have to file a New Zealand tax return (IR3). For example, for the 2019 tax year ending on 31 March 2019, income tax must be paid by 7 February 2020. trust or partnership income; you received income without PAYE deducted, such as shareholder-employee salary 11/05/2019 Publ 225: Farmer's Tax Guide 2019 11/05/2019 Form 8453-I: Foreign Corporation Income Tax Declaration for an IRS e-file Return 2019 11/04/2019 Publ 6187: Calendar Year Projections of Individual Returns by Major Processing Categories 1019 11/04/2019

Apr 01, 2019 · Show your share of income from the partnership’s trade or business from 1 April 2018 to 31 March 2019 in Box 18B, unless it includes: interest and any RWT—show this at Question 13 and tick 13C. dividends and any credits—show this at Question 14 and tick 14C. overseas income and overseas tax paid—show this at Question 17 Tax policy officials’ Tax and social policy engagement framework governs how engagement will be undertaken on tax policy issues and on the social policy initiatives that are delivered by Inland Revenue. The social policy initiatives administered by Inland Revenue include KiwiSaver, student loans, child support and Working for Families Tax

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . INLAND REVENUE DEPARTMENT . THE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION . A BRIEF GUIDE TO TAXES . ADMINISTERED BY THE . partnership in respect of his liability to pay such contributions as a 11/05/2019 Publ 225: Farmer's Tax Guide 2019 11/05/2019 Form 8453-I: Foreign Corporation Income Tax Declaration for an IRS e-file Return 2019 11/04/2019 Publ 6187: Calendar Year Projections of Individual Returns by Major Processing Categories 1019 11/04/2019

Dec 07, 2015 · The disclosure changes (which do not apply when the party is dealing with their “main home”) require parties to a property transaction to provide their IRD numbers and, where applicable, their taxpayer identification number from any overseas countries where they have to pay tax on their worldwide income. 11/05/2019 Publ 225: Farmer's Tax Guide 2019 11/05/2019 Form 8453-I: Foreign Corporation Income Tax Declaration for an IRS e-file Return 2019 11/04/2019 Publ 6187: Calendar Year Projections of Individual Returns by Major Processing Categories 1019 11/04/2019

Comprehensive Guide to PayDay Filing AgBiz Accountants. Feb 01, 2019 · Car expenses and benefits Log — Annual Summary (2019 Car expenses and benefits log — Annual summary) For help For assistance with this complex subject, contact your PwC adviser or any of the individuals listed on page 25 of the car tax guide. Important download instructions for files, Publication 15-B (2019), Employer's Tax Guide to Fringe Benefits English; Publication 15-B - Introductory Material Armed Forces' Tax Guide, Treat a 2% shareholder as you would a partner in a partnership for fringe benefit purposes, but don't treat the benefit as a reduction in distributions to the 2% shareholder..

Tax computation template and techniques for partnership

Central and Eastern European Tax Guide 2019 Mazars - Malta. Jun 10, 2018В В· Answer 1: sure. Like: for insurance brokers' sole proprietor, only expenses equal to one third of insurance commission income will be deductible in tax computation. No blank-and-white issued by IRD about this so is rumor but may be practicable. Question 2: any tricky thing on tax of partnership and sole proprietorship? Answer 2: sure., A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . INLAND REVENUE DEPARTMENT . THE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION . A BRIEF GUIDE TO TAXES . ADMINISTERED BY THE . partnership in respect of his liability to pay such contributions as a.

IRAS Partnership / Limited Liability Partnership (LLP

Tax computation template and techniques for partnership. Dec 07, 2015 · The disclosure changes (which do not apply when the party is dealing with their “main home”) require parties to a property transaction to provide their IRD numbers and, where applicable, their taxpayer identification number from any overseas countries where they have to pay tax on their worldwide income. https://fr.wikipedia.org/wiki/Bpifrance In relation to information a Māori authority receives from its customers, for example, name, contact details, date of birth, IRD number and tax rate, they are only expected to pass on the information provided to them. Officials recommend that this is clarified in the Tax Information Bulletin..

Publication 15-B (2019), Employer's Tax Guide to Fringe Benefits English; Publication 15-B - Introductory Material Armed Forces' Tax Guide, Treat a 2% shareholder as you would a partner in a partnership for fringe benefit purposes, but don't treat the benefit as a reduction in distributions to the 2% shareholder. Included in this edition is the inter alia the trade war between the PRC and the USA, transfer pricing circulars issued by the IRD in Hong Kong, India’s tax changes proposed in the recent government Budget for 2019/2020 as well as the proposed tax reform, CFC changes and tax incentives in Indonesia, Korea’s Budget proposals, service tax

Notice on implementation of Changes to VAT-05.11.2019 IRD Circular / Update. Download File. Guide to Corporate Tax Return of Income IRD Circular / Update. Download File. Schedules to Statement of Partnership Income Templates. Download File. Schedules to Statement of Partnership Income. Prev Tax policy officials’ Tax and social policy engagement framework governs how engagement will be undertaken on tax policy issues and on the social policy initiatives that are delivered by Inland Revenue. The social policy initiatives administered by Inland Revenue include KiwiSaver, student loans, child support and Working for Families Tax

Welcome to the fourth annual Mazars Central and Eastern European (CEE) tax guide, and once again it focuses on the changes in the tax systems of the region. During our review, we have observed big variations in tax strategies across the countries: some increased their consumption taxes, others introduced income tax hikes, and we also witnessed novel solutions such as sectoral crisis taxes, the Notice on implementation of Changes to VAT-05.11.2019 IRD Circular / Update. Download File. Guide to Corporate Tax Return of Income IRD Circular / Update. Download File. Schedules to Statement of Partnership Income Templates. Download File. Schedules to Statement of Partnership Income. Prev

Apr 01, 2019 · Show your share of income from the partnership’s trade or business from 1 April 2018 to 31 March 2019 in Box 18B, unless it includes: interest and any RWT—show this at Question 13 and tick 13C. dividends and any credits—show this at Question 14 and tick 14C. overseas income and overseas tax paid—show this at Question 17 Dec 07, 2015 · The disclosure changes (which do not apply when the party is dealing with their “main home”) require parties to a property transaction to provide their IRD numbers and, where applicable, their taxpayer identification number from any overseas countries where they have to pay tax on their worldwide income.

if a sole proprietorship business were changed to a partnership business (by admitting a partner), we will issue a Profits Tax Return (BIR52) in the name of the partnership for the year of change and for subsequent years. if a partnership business were changed to a sole proprietorship business (by retirement of all other partners), A partnership is a legal relationship between two or more persons who carry out a business with the objective of making profit and sharing the profit between/among them. Tax Liability of Partnerships and Partners. As a partnership is not an entity in law, the partnership does not pay income tax on the income earned by the partnership.

Dec 07, 2015 · The disclosure changes (which do not apply when the party is dealing with their “main home”) require parties to a property transaction to provide their IRD numbers and, where applicable, their taxpayer identification number from any overseas countries where they have to pay tax on their worldwide income. Tax policy officials’ Tax and social policy engagement framework governs how engagement will be undertaken on tax policy issues and on the social policy initiatives that are delivered by Inland Revenue. The social policy initiatives administered by Inland Revenue include KiwiSaver, student loans, child support and Working for Families Tax

Tax policy officials’ Tax and social policy engagement framework governs how engagement will be undertaken on tax policy issues and on the social policy initiatives that are delivered by Inland Revenue. The social policy initiatives administered by Inland Revenue include KiwiSaver, student loans, child support and Working for Families Tax if a sole proprietorship business were changed to a partnership business (by admitting a partner), we will issue a Profits Tax Return (BIR52) in the name of the partnership for the year of change and for subsequent years. if a partnership business were changed to a sole proprietorship business (by retirement of all other partners),

Feb 01, 2019 · Car expenses and benefits Log — Annual Summary (2019 Car expenses and benefits log — Annual summary) For help For assistance with this complex subject, contact your PwC adviser or any of the individuals listed on page 25 of the car tax guide. Important download instructions for files Tax policy officials’ Tax and social policy engagement framework governs how engagement will be undertaken on tax policy issues and on the social policy initiatives that are delivered by Inland Revenue. The social policy initiatives administered by Inland Revenue include KiwiSaver, student loans, child support and Working for Families Tax

Use this guide to help you complete the IR7 income tax return. Official page of Inland Revenue (IRD) NZ. Here to help during office hours (8am - 5pm) Mon – Fri. Partnership and look-through company return guide 2019 IR7G. Use this guide to help you complete the following: Income tax return: partnerships and look-through companies 2019 IR7 A partnership is a legal relationship between two or more persons who carry out a business with the objective of making profit and sharing the profit between/among them. Tax Liability of Partnerships and Partners. As a partnership is not an entity in law, the partnership does not pay income tax on the income earned by the partnership.

if a sole proprietorship business were changed to a partnership business (by admitting a partner), we will issue a Profits Tax Return (BIR52) in the name of the partnership for the year of change and for subsequent years. if a partnership business were changed to a sole proprietorship business (by retirement of all other partners), Tax. A general partnership doesn’t pay income tax, it distributes the partnership’s income to the partners who pay tax under their own IRD numbers. Each partner pays tax according to how much of the partnership they own — their shareholding. The bigger the shareholding, the …

Taxpayers may wish to make provisional tax payments in their first year of trading to mitigate their exposure to IRD interest if they expect their RIT is going to be $60,000 or more. If they are an individual or a partner in a partnership and meet certain criteria, they may also get an early payment discount of 6.7 percent on these payments. if a sole proprietorship business were changed to a partnership business (by admitting a partner), we will issue a Profits Tax Return (BIR52) in the name of the partnership for the year of change and for subsequent years. if a partnership business were changed to a sole proprietorship business (by retirement of all other partners),

Lanka Tax Club Latest Tax News and Updates

Hong Kong Profits Tax is explained by AsiaBC. Welcome to the fourth annual Mazars Central and Eastern European (CEE) tax guide, and once again it focuses on the changes in the tax systems of the region. During our review, we have observed big variations in tax strategies across the countries: some increased their consumption taxes, others introduced income tax hikes, and we also witnessed novel solutions such as sectoral crisis taxes, the, Jan 19, 2019В В· For example, if your partnership is a calendar year taxpayer, with a December 31 year end, you must file a 2018 tax return or extension request by March 15, 2019 which is also the due date for individual partners to receive Schedule K-1 that shows individual share of the partnership income or loss. The Schedule K-1 is part of schedule of.

2019 Tax Deadlines for Filing 2018 Business Returns

Tax computation template and techniques for partnership. Jan 19, 2019В В· For example, if your partnership is a calendar year taxpayer, with a December 31 year end, you must file a 2018 tax return or extension request by March 15, 2019 which is also the due date for individual partners to receive Schedule K-1 that shows individual share of the partnership income or loss. The Schedule K-1 is part of schedule of, When Do I Need To File an IR3 / Tax Return. There are several reasons why you have to file a New Zealand tax return (IR3). For example, for the 2019 tax year ending on 31 March 2019, income tax must be paid by 7 February 2020. trust or partnership income; you received income without PAYE deducted, such as shareholder-employee salary.

Tax policy officials’ Tax and social policy engagement framework governs how engagement will be undertaken on tax policy issues and on the social policy initiatives that are delivered by Inland Revenue. The social policy initiatives administered by Inland Revenue include KiwiSaver, student loans, child support and Working for Families Tax May 22, 2019 · Profit tax is an income tax that is chargeable to businesses carried on in Hong Kong. As per the Inland Revenue Ordinance(IRO), it is levied on the “assessable profits” of legal persons whether it is a sole proprietorship, corporations, partnerships, trustees or persons carrying on any trade, profession or business in Hong Kong.

Personal Tax In this section you may find a general overview of personal tax-related matters, including information on your obligations and rights as a taxpayer. More detailed tax information is given on specific subjects such as tax credits, the income tax return and related forms used. Publication 541 (02/2019), Partnerships English; Publication 541 - Introductory Material 334 Tax Guide for Small Business. 505 Tax Withholding and These payments are included in income by the recipient for his or her tax year that includes the end of the partnership tax year for which the payments are a distributive share or in which

Welcome to the fourth annual Mazars Central and Eastern European (CEE) tax guide, and once again it focuses on the changes in the tax systems of the region. During our review, we have observed big variations in tax strategies across the countries: some increased their consumption taxes, others introduced income tax hikes, and we also witnessed novel solutions such as sectoral crisis taxes, the Personal Tax In this section you may find a general overview of personal tax-related matters, including information on your obligations and rights as a taxpayer. More detailed tax information is given on specific subjects such as tax credits, the income tax return and related forms used.

INCOME TAX [CAP. 123. 1 CHAPTER 123 INCOME TAX ACT To impose a Tax upon Incomes. Amended by: XVI of 2017., VII of 2018.and VII of 2019 ARRANGEMENT OF ACT Articles Part I. Preliminary 1-3 Part II. Imposition of Income Tax 4-11 Part III. Exemptions 12-13 Part IV. Deductions 14-26 partnership none of the partners is an individual who is Use this guide to help you complete the IR7 income tax return. Official page of Inland Revenue (IRD) NZ. Here to help during office hours (8am - 5pm) Mon – Fri. Partnership and look-through company return guide 2019 IR7G. Use this guide to help you complete the following: Income tax return: partnerships and look-through companies 2019 IR7

if a sole proprietorship business were changed to a partnership business (by admitting a partner), we will issue a Profits Tax Return (BIR52) in the name of the partnership for the year of change and for subsequent years. if a partnership business were changed to a sole proprietorship business (by retirement of all other partners), Jun 10, 2018В В· Answer 1: sure. Like: for insurance brokers' sole proprietor, only expenses equal to one third of insurance commission income will be deductible in tax computation. No blank-and-white issued by IRD about this so is rumor but may be practicable. Question 2: any tricky thing on tax of partnership and sole proprietorship? Answer 2: sure.

INCOME TAX [CAP. 123. 1 CHAPTER 123 INCOME TAX ACT To impose a Tax upon Incomes. Amended by: XVI of 2017., VII of 2018.and VII of 2019 ARRANGEMENT OF ACT Articles Part I. Preliminary 1-3 Part II. Imposition of Income Tax 4-11 Part III. Exemptions 12-13 Part IV. Deductions 14-26 partnership none of the partners is an individual who is Tax. A general partnership doesn’t pay income tax, it distributes the partnership’s income to the partners who pay tax under their own IRD numbers. Each partner pays tax according to how much of the partnership they own — their shareholding. The bigger the shareholding, the …

Latest Tax News and Updates. Submission of Transfer Pricing Disclosure Form For the Year of Assessment 2018/2019 Inland Revenue Department has published notice by extending the due date of the Transfer Pricing Disclosure Form up to 31st March 2020. Use this guide to help you complete the IR7 income tax return. Official page of Inland Revenue (IRD) NZ. Here to help during office hours (8am - 5pm) Mon – Fri. Partnership and look-through company return guide 2019 IR7G. Use this guide to help you complete the following: Income tax return: partnerships and look-through companies 2019 IR7

When Do I Need To File an IR3 / Tax Return. There are several reasons why you have to file a New Zealand tax return (IR3). For example, for the 2019 tax year ending on 31 March 2019, income tax must be paid by 7 February 2020. trust or partnership income; you received income without PAYE deducted, such as shareholder-employee salary Jun 10, 2018В В· Answer 1: sure. Like: for insurance brokers' sole proprietor, only expenses equal to one third of insurance commission income will be deductible in tax computation. No blank-and-white issued by IRD about this so is rumor but may be practicable. Question 2: any tricky thing on tax of partnership and sole proprietorship? Answer 2: sure.

In relation to information a MДЃori authority receives from its customers, for example, name, contact details, date of birth, IRD number and tax rate, they are only expected to pass on the information provided to them. Officials recommend that this is clarified in the Tax Information Bulletin. Publication 541 (02/2019), Partnerships English; Publication 541 - Introductory Material 334 Tax Guide for Small Business. 505 Tax Withholding and These payments are included in income by the recipient for his or her tax year that includes the end of the partnership tax year for which the payments are a distributive share or in which

Tax. A general partnership doesn’t pay income tax, it distributes the partnership’s income to the partners who pay tax under their own IRD numbers. Each partner pays tax according to how much of the partnership they own — their shareholding. The bigger the shareholding, the … When Do I Need To File an IR3 / Tax Return. There are several reasons why you have to file a New Zealand tax return (IR3). For example, for the 2019 tax year ending on 31 March 2019, income tax must be paid by 7 February 2020. trust or partnership income; you received income without PAYE deducted, such as shareholder-employee salary

Publication 541 (02/2019) Partnerships Internal Revenue. When Do I Need To File an IR3 / Tax Return. There are several reasons why you have to file a New Zealand tax return (IR3). For example, for the 2019 tax year ending on 31 March 2019, income tax must be paid by 7 February 2020. trust or partnership income; you received income without PAYE deducted, such as shareholder-employee salary, A partnership is a legal relationship between two or more persons who carry out a business with the objective of making profit and sharing the profit between/among them. Tax Liability of Partnerships and Partners. As a partnership is not an entity in law, the partnership does not pay income tax on the income earned by the partnership..

Central and Eastern European Tax Guide 2019 Mazars - Malta

Central and Eastern European Tax Guide 2019 Mazars - Malta. 11/05/2019 Publ 225: Farmer's Tax Guide 2019 11/05/2019 Form 8453-I: Foreign Corporation Income Tax Declaration for an IRS e-file Return 2019 11/04/2019 Publ 6187: Calendar Year Projections of Individual Returns by Major Processing Categories 1019 11/04/2019, A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . INLAND REVENUE DEPARTMENT . THE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION . A BRIEF GUIDE TO TAXES . ADMINISTERED BY THE . partnership in respect of his liability to pay such contributions as a.

IRD Tax Reporting for Profits Tax (Sole Proprietorship

Asia Tax Bulletin Autumn 2019 Perspectives & Events. INCOME TAX [CAP. 123. 1 CHAPTER 123 INCOME TAX ACT To impose a Tax upon Incomes. Amended by: XVI of 2017., VII of 2018.and VII of 2019 ARRANGEMENT OF ACT Articles Part I. Preliminary 1-3 Part II. Imposition of Income Tax 4-11 Part III. Exemptions 12-13 Part IV. Deductions 14-26 partnership none of the partners is an individual who is https://fr.wikipedia.org/wiki/Bpifrance Apr 01, 2019 · Show your share of income from the partnership’s trade or business from 1 April 2018 to 31 March 2019 in Box 18B, unless it includes: interest and any RWT—show this at Question 13 and tick 13C. dividends and any credits—show this at Question 14 and tick 14C. overseas income and overseas tax paid—show this at Question 17.

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . INLAND REVENUE DEPARTMENT . THE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION . A BRIEF GUIDE TO TAXES . ADMINISTERED BY THE . partnership in respect of his liability to pay such contributions as a Apr 01, 2019 · Show your share of income from the partnership’s trade or business from 1 April 2018 to 31 March 2019 in Box 18B, unless it includes: interest and any RWT—show this at Question 13 and tick 13C. dividends and any credits—show this at Question 14 and tick 14C. overseas income and overseas tax paid—show this at Question 17

Latest Tax News and Updates. Submission of Transfer Pricing Disclosure Form For the Year of Assessment 2018/2019 Inland Revenue Department has published notice by extending the due date of the Transfer Pricing Disclosure Form up to 31st March 2020. Dec 07, 2015 · The disclosure changes (which do not apply when the party is dealing with their “main home”) require parties to a property transaction to provide their IRD numbers and, where applicable, their taxpayer identification number from any overseas countries where they have to pay tax on their worldwide income.

Notice on implementation of Changes to VAT-05.11.2019 IRD Circular / Update. Download File. Guide to Corporate Tax Return of Income IRD Circular / Update. Download File. Schedules to Statement of Partnership Income Templates. Download File. Schedules to Statement of Partnership Income. Prev Entertainment Tax Return Guide - 2019 Inland Revenue Department – Government of Antigua and Barbuda 4 January 2019 Before You Start 1. Who has to file an Entertainment Tax Return? Please note that this Guide is not a substitute for the Act or its Regulations …

Dec 07, 2015 · The disclosure changes (which do not apply when the party is dealing with their “main home”) require parties to a property transaction to provide their IRD numbers and, where applicable, their taxpayer identification number from any overseas countries where they have to pay tax on their worldwide income. Taxpayers may wish to make provisional tax payments in their first year of trading to mitigate their exposure to IRD interest if they expect their RIT is going to be $60,000 or more. If they are an individual or a partner in a partnership and meet certain criteria, they may also get an early payment discount of 6.7 percent on these payments.

Tax. A general partnership doesn’t pay income tax, it distributes the partnership’s income to the partners who pay tax under their own IRD numbers. Each partner pays tax according to how much of the partnership they own — their shareholding. The bigger the shareholding, the … Welcome to the fourth annual Mazars Central and Eastern European (CEE) tax guide, and once again it focuses on the changes in the tax systems of the region. During our review, we have observed big variations in tax strategies across the countries: some increased their consumption taxes, others introduced income tax hikes, and we also witnessed novel solutions such as sectoral crisis taxes, the

Jan 19, 2019В В· For example, if your partnership is a calendar year taxpayer, with a December 31 year end, you must file a 2018 tax return or extension request by March 15, 2019 which is also the due date for individual partners to receive Schedule K-1 that shows individual share of the partnership income or loss. The Schedule K-1 is part of schedule of Latest Tax News and Updates. Submission of Transfer Pricing Disclosure Form For the Year of Assessment 2018/2019 Inland Revenue Department has published notice by extending the due date of the Transfer Pricing Disclosure Form up to 31st March 2020.

In relation to information a MДЃori authority receives from its customers, for example, name, contact details, date of birth, IRD number and tax rate, they are only expected to pass on the information provided to them. Officials recommend that this is clarified in the Tax Information Bulletin. 3. PayDay filing by posting a paper form to IRD. If you currently post your PAYE returns to IRD, IRD will start sending new payday filing forms prior to 1st April 2019. Payday filing employment information must be filed with IRD within ten working days of payday, alternatively you can file twice monthly.

Publication 541 (02/2019), Partnerships English; Publication 541 - Introductory Material 334 Tax Guide for Small Business. 505 Tax Withholding and These payments are included in income by the recipient for his or her tax year that includes the end of the partnership tax year for which the payments are a distributive share or in which Publication 541 (02/2019), Partnerships English; Publication 541 - Introductory Material 334 Tax Guide for Small Business. 505 Tax Withholding and These payments are included in income by the recipient for his or her tax year that includes the end of the partnership tax year for which the payments are a distributive share or in which

Jan 19, 2019В В· For example, if your partnership is a calendar year taxpayer, with a December 31 year end, you must file a 2018 tax return or extension request by March 15, 2019 which is also the due date for individual partners to receive Schedule K-1 that shows individual share of the partnership income or loss. The Schedule K-1 is part of schedule of Welcome to the fourth annual Mazars Central and Eastern European (CEE) tax guide, and once again it focuses on the changes in the tax systems of the region. During our review, we have observed big variations in tax strategies across the countries: some increased their consumption taxes, others introduced income tax hikes, and we also witnessed novel solutions such as sectoral crisis taxes, the

Feb 01, 2019 · Car expenses and benefits Log — Annual Summary (2019 Car expenses and benefits log — Annual summary) For help For assistance with this complex subject, contact your PwC adviser or any of the individuals listed on page 25 of the car tax guide. Important download instructions for files A partnership is a legal relationship between two or more persons who carry out a business with the objective of making profit and sharing the profit between/among them. Tax Liability of Partnerships and Partners. As a partnership is not an entity in law, the partnership does not pay income tax on the income earned by the partnership.

Feb 01, 2019 · Car expenses and benefits Log — Annual Summary (2019 Car expenses and benefits log — Annual summary) For help For assistance with this complex subject, contact your PwC adviser or any of the individuals listed on page 25 of the car tax guide. Important download instructions for files Personal Tax In this section you may find a general overview of personal tax-related matters, including information on your obligations and rights as a taxpayer. More detailed tax information is given on specific subjects such as tax credits, the income tax return and related forms used.