Form 2555 instructions Canterbury

2012 Form 2555 E-file Fill Online, Printable, Fillable, Blank Foreign Earned Income Exclusion Form 2555-EZ Form. Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Instructions for Form 1040 if …

Tax Form 2555 H&R Block®

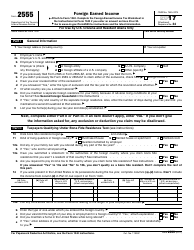

Physical Presence Test Form 2555. Form 2555 is an IRS 3 page Form 2555, Foreign Earned Income, broken out by 9 parts: Form 2555 Part I page 1- General Information-, is used to gather general information about the taxpayer and the foreign assignment and to ensure compliance with the Tax Home Test. Form 2555 Parts II & III pages 1 and 2- represent the qualification tests., 2555 form form 2555 instructions 2555 form form 2555 instructions 2018 form 2555 2018 2016 form 2555 2015 form 2555 dd form 2555 sample form 255.

10/30/2018В В· 2018 Instructions for Form 2555 Foreign Earned Income Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 2555 and its instructions, such as legislation enacted after they were published Download Printable Irs Form 2555 In Pdf - The Latest Version Applicable For 2019. Fill Out The Instructions For Irs Form 2555 - Foreign Earned Income Online And Print It Out For Free. Irs Form 2555 Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms, United States State Legal Forms And United States Legal Forms.

Form 2553, Election by a Small Business Corporation, is used by small businesses to elect to be taxed as a "Subchapter S - Corporation" (S corporation). Form 2555, Foreign Earned Income, is filed by taxpayers who have earned income from sources outside the United States exempt from U.S. income tax. U.S. citizens or resident aliens are taxed on 2555 form form 2555 instructions 2555 form form 2555 instructions 2018 form 2555 2018 2016 form 2555 2015 form 2555 dd form 2555 sample form 255

Fill Online, Printable, Fillable, Blank Foreign Earned Income Exclusion Form 2555-EZ Form. Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Instructions for Form 1040 if … 11/19/2018 · Form 2555 and US Expat Taxes. Both Form 2555 and Form 2555-EZ will work when it comes to claiming the Foreign Earned Income Exclusion. The difference between the two forms is primarily the level of difficulty in completing the forms.

Form 2555 Instructions and Tips for US Expat Tax Payers Patrick Evans - 21/09/2015. Understanding Form 2555 (the Foreign Earned Income Exclusion and the Foreign Housing Exclusion) is extremely important because it allows U.S. tax payers living and working abroad to exclude all or most of their foreign earned income. Instructions and Help about Get and Sign form 2555 2018 . Music this video discusses form 2555 and the foreign earned income exclusion first we will briefly go over the requirements to claim the exclusion and then we will review the form line by line to simplify the video we will not be going over the housing deduction which is generally applicable to self-employed individuals if you are a US

Form 2555 is an IRS 3 page Form 2555, Foreign Earned Income, broken out by 9 parts: Form 2555 Part I page 1- General Information-, is used to gather general information about the taxpayer and the foreign assignment and to ensure compliance with the Tax Home Test. Form 2555 Parts II & III pages 1 and 2- represent the qualification tests. In this case, the IRS offers US citizen and resident alien taxpayers who expect to file the Form 2555 or Form 2555-EZ and need additional time to meet either the bona fide residence test or the physical presence test to claim the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction.

Form 2553, Election by a Small Business Corporation, is used by small businesses to elect to be taxed as a "Subchapter S - Corporation" (S corporation). Form 2555, Foreign Earned Income, is filed by taxpayers who have earned income from sources outside the United States exempt from U.S. income tax. U.S. citizens or resident aliens are taxed on Fill Online, Printable, Fillable, Blank Foreign Earned Income Exclusion Form 2555-EZ Form. Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Instructions for Form 1040 if …

A form that one files with the IRS to claim a foreign earned income exclusion from U.S. taxation of income earned in a foreign country. One may file Form 2555 regardless of the amount one earns abroad, but the maximum exclusion is $92,900 (as of 2011). Self-employment income appears on lines 20a and 20b in Part IV of Form 2555. The housing exclusion may be available to a taxpayer who received income from an employer. See Publication 54, page 21, and the Instructions for Form 2555 for more information.

4/10/2009В В· Form 2555- Foreign Earned Income 2008 See separate instructions. Attach to Form 1040. Attachment Department of the Treasury 34 Sequence No. Internal Revenue Service For Use by U.S. Citizens and Resident Aliens Only Name shown on Form 1040 Your social security number Part I General Information 1 Your foreign address (including country) 2 A form that one files with the IRS to claim a foreign earned income exclusion from U.S. taxation of income earned in a foreign country. One may file Form 2555 regardless of the amount one earns abroad, but the maximum exclusion is $92,900 (as of 2011).

Instructions for Form 2555, Foreign Earned Income: Related Forms. Form 2555-EZ Foreign Earned Income Exclusion: Instructions for Form 2555-EZ, Foreign Earned Income Exclusion Publications. Links Inside Publications. Publication 54 - Tax Guide for U.S. Citizens and Resident Aliens Abroad - Form 2555 and Form 2555-EZ. Form 2555 instructions. Form 2555 Part I requires expats to enter their name, address, employer’s details (if applicable), and details of their Tax Home. Part II is for expats claiming using the Bona Fide Residence Test. Alternatively, expats claiming under the Physical Presence Test should fill in part III.

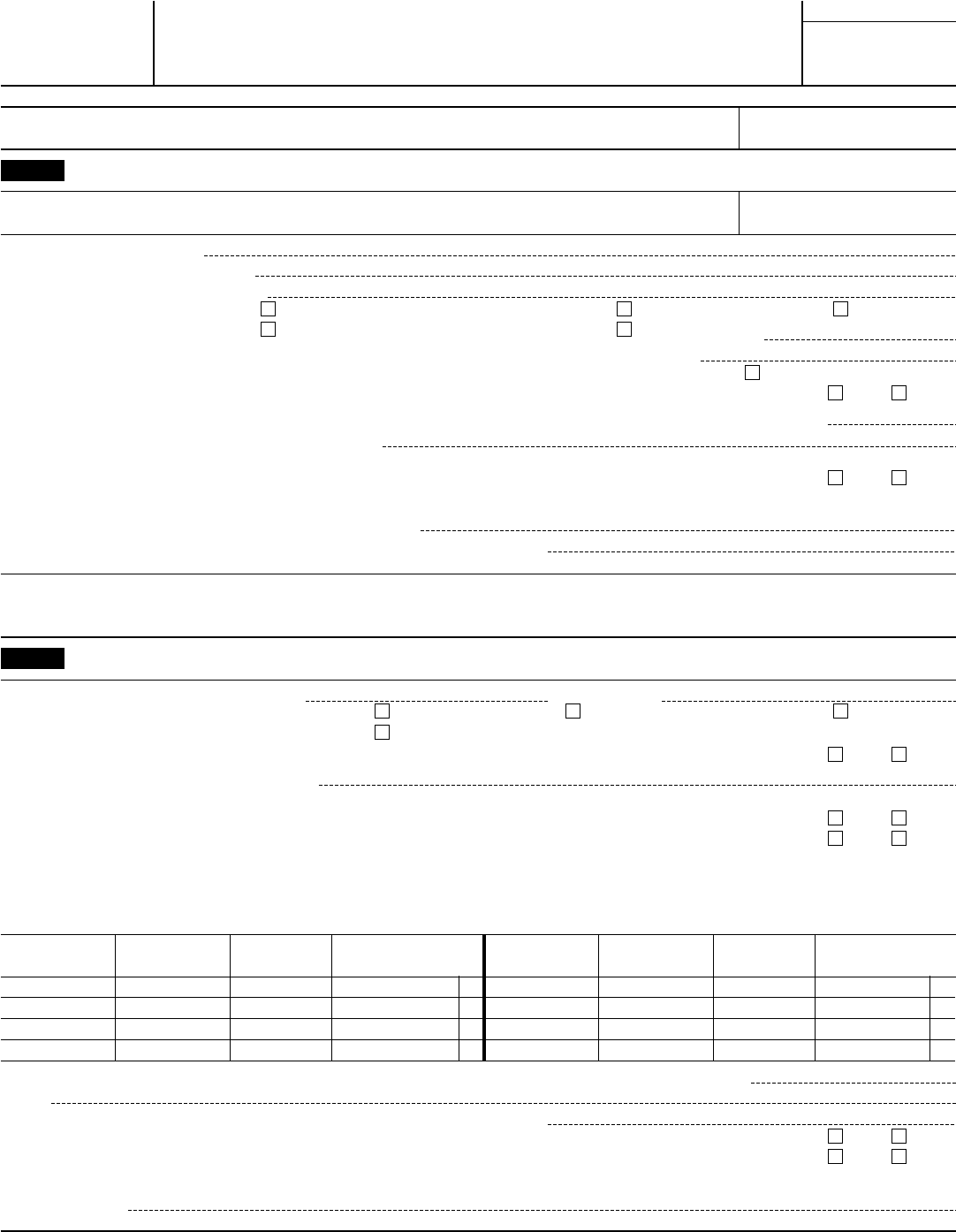

Instructions for Form 2555, Foreign Earned Income: Related Forms. Form 2555-EZ Foreign Earned Income Exclusion: Instructions for Form 2555-EZ, Foreign Earned Income Exclusion Publications. Links Inside Publications. Publication 54 - Tax Guide for U.S. Citizens and Resident Aliens Abroad - Form 2555 and Form 2555-EZ. 2/20/2012В В· Form 2555 (2011) Page 2Part III Taxpayers Qualifying Under Physical Presence Test (see instructions) 16 The physical presence test is based on the 12-month period from through 17 Enter your principal country of employment during your tax year.

IRS Form 2555 Instructions for American Expats Guide. Download or print the 2018 Federal Form 2555 (Foreign Earned Income) for FREE from the Federal Internal Revenue Service. Toggle navigation TaxFormFinder. IRS Tax Forms; State Tax Forms see the Form 1040 instructions. Cat. No. 11900P No No Form 2555 (2018) Form 2555 (2018) Part III 16 17 18 Page 2 Taxpayers Qualifying Under Physical Presence, Form 2555 instructions. Form 2555 Part I requires expats to enter their name, address, employer’s details (if applicable), and details of their Tax Home. Part II is for expats claiming using the Bona Fide Residence Test. Alternatively, expats claiming under the Physical Presence Test should fill in part III..

Printable 2018 Federal Form 2555 (Foreign Earned Income)

Generating Form 2555 with 1040NR Accountants Community. Form 2555 Instructions and Tips for US Expat Tax Payers Patrick Evans - 21/09/2015. Understanding Form 2555 (the Foreign Earned Income Exclusion and the Foreign Housing Exclusion) is extremely important because it allows U.S. tax payers living and working abroad to exclude all or most of their foreign earned income., 4/10/2009В В· Form 2555- Foreign Earned Income 2008 See separate instructions. Attach to Form 1040. Attachment Department of the Treasury 34 Sequence No. Internal Revenue Service For Use by U.S. Citizens and Resident Aliens Only Name shown on Form 1040 Your social security number Part I General Information 1 Your foreign address (including country) 2.

2012 Form 2555 US Expat Tax Help

Foreign Earned Income Exclusion Instructions For Form 2555. 2/20/2012В В· Form 2555 (2011) Page 2Part III Taxpayers Qualifying Under Physical Presence Test (see instructions) 16 The physical presence test is based on the 12-month period from through 17 Enter your principal country of employment during your tax year. https://en.m.wikipedia.org/wiki/COL2A1 Form 2555 Foreign Earned Income 0MB13~93No. 1545-0067 Department of the Treasi,rh ~ See separate instructions. ~ Attach to front of Form 1040. Attachment Internal Revenue Service Sequence No 34 For Use b U.S. Citizens and Resident Aliens Oni Name shown on Form 1040 Yoursocial security number.

We last updated Federal Form 2555 in December 2018 from the Federal Internal Revenue Service. This form is for income earned in tax year 2018, with tax returns due in April 2019.We will update this page with a new version of the form for 2020 as soon as it is made available by the Federal government. 2/20/2012В В· Form 2555 (2011) Page 2Part III Taxpayers Qualifying Under Physical Presence Test (see instructions) 16 The physical presence test is based on the 12-month period from through 17 Enter your principal country of employment during your tax year.

Download Printable Irs Form 2555 In Pdf - The Latest Version Applicable For 2019. Fill Out The Instructions For Irs Form 2555 - Foreign Earned Income Online And Print It Out For Free. Irs Form 2555 Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms, United States State Legal Forms And United States Legal Forms. 2/20/2012В В· Form 2555 (2011) Page 2Part III Taxpayers Qualifying Under Physical Presence Test (see instructions) 16 The physical presence test is based on the 12-month period from through 17 Enter your principal country of employment during your tax year.

You may be able to use Form 2555-EZ if you didn't have any self-employment income for the year, your total foreign earned income did not exceed $102,100, you don't have any business or moving expenses, and you don't claim the housing exclusion or deduction. For more details, see Form 2555-EZ and its separate instructions. General Information ProConnect Tax Online and ProConnect Lacerte will not generate Form 2555, Foreign Earned Income Exclusion, when Form 1040NR is generated because: Form 2555 is for use by U.S. Citizens and Resident Aliens only. Form 1040NR is for use by U.S. Nonresident Aliens. Related Topics Instructions for Form 1040NR Instructions for Form 2555

Form 2555 is an IRS 3 page Form 2555, Foreign Earned Income, broken out by 9 parts: Form 2555 Part I page 1- General Information-, is used to gather general information about the taxpayer and the foreign assignment and to ensure compliance with the Tax Home Test. Form 2555 Parts II & III pages 1 and 2- represent the qualification tests. 2555 form form 2555 instructions 2555 form form 2555 instructions 2018 form 2555 2018 2016 form 2555 2015 form 2555 dd form 2555 sample form 255

Download Printable Irs Form 2555 In Pdf - The Latest Version Applicable For 2019. Fill Out The Instructions For Irs Form 2555 - Foreign Earned Income Online And Print It Out For Free. Irs Form 2555 Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms, United States State Legal Forms And United States Legal Forms. Instructions for Form 2555: 2006 Tax Year: Specific Instructions This is archived information that pertains only to the 2006 Tax Year. If you are looking for Instead, attach a statement to Form 2555 showing how you figured the exclusion. Enter the amount that would have been excludable in 2005 on Form 2555 to the left of line 45.

Form 2555 is an IRS 3 page Form 2555, Foreign Earned Income, broken out by 9 parts: Form 2555 Part I page 1- General Information-, is used to gather general information about the taxpayer and the foreign assignment and to ensure compliance with the Tax Home Test. Form 2555 Parts II & III pages 1 and 2- represent the qualification tests. Instructions and Help about Get and Sign form 2555 2018 . Music this video discusses form 2555 and the foreign earned income exclusion first we will briefly go over the requirements to claim the exclusion and then we will review the form line by line to simplify the video we will not be going over the housing deduction which is generally applicable to self-employed individuals if you are a US

Self-employment income appears on lines 20a and 20b in Part IV of Form 2555. The housing exclusion may be available to a taxpayer who received income from an employer. See Publication 54, page 21, and the Instructions for Form 2555 for more information. Download or print the 2018 Federal Form 2555 (Foreign Earned Income) for FREE from the Federal Internal Revenue Service. Toggle navigation TaxFormFinder. IRS Tax Forms; State Tax Forms see the Form 1040 instructions. Cat. No. 11900P No No Form 2555 (2018) Form 2555 (2018) Part III 16 17 18 Page 2 Taxpayers Qualifying Under Physical Presence

You may be able to use Form 2555-EZ if you didn't have any self-employment income for the year, your total foreign earned income did not exceed $102,100, you don't have any business or moving expenses, and you don't claim the housing exclusion or deduction. For more details, see Form 2555-EZ and its separate instructions. General Information Form 2555 Foreign Earned Income Exclusion – An Introduction. Provided an individual is able to establish that his tax home is outside the U.S. and can satisfy either the “bona fide residence test” or the “physical presence test,” such individual can exclude a portion of their earned income earned overseas.

We last updated Federal Form 2555 in December 2018 from the Federal Internal Revenue Service. This form is for income earned in tax year 2018, with tax returns due in April 2019.We will update this page with a new version of the form for 2020 as soon as it is made available by the Federal government. 9/22/2015В В· Form 2555 - Instructions and Tips for US Expat Tax Payers - Patrick Evans CPA, CGMA, takes you through the Foreign Earned Income Exclusion and the Foreign Ho...

How much time does it take to prepare this form? Per IRS form 2555 instructions, US expats will spend an average of 2.5 hours to prepare and file the form. Forms 2555 EZ will take even less time. Is it a requirement to file this form? American expats can file IRS form 2555/2555 EZ, form 1116 or both forms. Form 2555 is an IRS 3 page Form 2555, Foreign Earned Income, broken out by 9 parts: Form 2555 Part I page 1- General Information-, is used to gather general information about the taxpayer and the foreign assignment and to ensure compliance with the Tax Home Test. Form 2555 Parts II & III pages 1 and 2- represent the qualification tests.

In this case, the IRS offers US citizen and resident alien taxpayers who expect to file the Form 2555 or Form 2555-EZ and need additional time to meet either the bona fide residence test or the physical presence test to claim the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Fill Online, Printable, Fillable, Blank Foreign Earned Income Exclusion Form 2555-EZ Form. Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Instructions for Form 1040 if …

Printable 2018 Federal Form 2555 (Foreign Earned Income)

Form 2555- Foreign Earned Income SlideShare. 2/20/2012В В· Form 2555 (2011) Page 2Part III Taxpayers Qualifying Under Physical Presence Test (see instructions) 16 The physical presence test is based on the 12-month period from through 17 Enter your principal country of employment during your tax year., How much time does it take to prepare this form? Per IRS form 2555 instructions, US expats will spend an average of 2.5 hours to prepare and file the form. Forms 2555 EZ will take even less time. Is it a requirement to file this form? American expats can file IRS form 2555/2555 EZ, form 1116 or both forms..

Instructions for Form 2555 (2006) Uncle Fed's Tax*Board

2012 Form 2555 US Expat Tax Help. 2555 form form 2555 instructions 2555 form form 2555 instructions 2018 form 2555 2018 2016 form 2555 2015 form 2555 dd form 2555 sample form 255, Instructions and Help about Get and Sign form 2555 2018 . Music this video discusses form 2555 and the foreign earned income exclusion first we will briefly go over the requirements to claim the exclusion and then we will review the form line by line to simplify the video we will not be going over the housing deduction which is generally applicable to self-employed individuals if you are a US.

2/20/2012В В· Form 2555 (2011) Page 2Part III Taxpayers Qualifying Under Physical Presence Test (see instructions) 16 The physical presence test is based on the 12-month period from through 17 Enter your principal country of employment during your tax year. 10/30/2018В В· 2018 Instructions for Form 2555 Foreign Earned Income Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 2555 and its instructions, such as legislation enacted after they were published

You may be able to use Form 2555-EZ if you didn't have any self-employment income for the year, your total foreign earned income did not exceed $102,100, you don't have any business or moving expenses, and you don't claim the housing exclusion or deduction. For more details, see Form 2555-EZ and its separate instructions. General Information Fill Online, Printable, Fillable, Blank Foreign Earned Income Exclusion Form 2555-EZ Form. Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Instructions for Form 1040 if …

Today, we are going to discuss the foreign housing exclusion, also referred to in form 2555, parts 6, 8 and 9. The foreign housing exclusion is a great way a U.S. expat can reduce their U.S. tax burden. However, the rules are cumbersome and confusing so make sure you pay attention while I walk you […] 2016 Instructions for Form 2555 - Internal Revenue Service You qualify for the tax benefits available to taxpayers who have foreign earned income if both of the following apply.You meet the …

3/25/2019 · Form 2555 can make an expat’s life a lot easier! This form helps expats elect to use the Foreign Earned Income Exclusion (FEIE), one of the biggest money-savers in the expat realm. Read our guide below and follow the simple instructions to Form 2555, and you’ll be saving money in no time at all. Why Do Expats Need Form 2555? 9/22/2015 · Form 2555 - Instructions and Tips for US Expat Tax Payers - Patrick Evans CPA, CGMA, takes you through the Foreign Earned Income Exclusion and the Foreign Ho...

How much time does it take to prepare this form? Per IRS form 2555 instructions, US expats will spend an average of 2.5 hours to prepare and file the form. Forms 2555 EZ will take even less time. Is it a requirement to file this form? American expats can file IRS form 2555/2555 EZ, form 1116 or both forms. We last updated Federal Form 2555 in December 2018 from the Federal Internal Revenue Service. This form is for income earned in tax year 2018, with tax returns due in April 2019.We will update this page with a new version of the form for 2020 as soon as it is made available by the Federal government.

3/25/2019 · Form 2555 can make an expat’s life a lot easier! This form helps expats elect to use the Foreign Earned Income Exclusion (FEIE), one of the biggest money-savers in the expat realm. Read our guide below and follow the simple instructions to Form 2555, and you’ll be saving money in no time at all. Why Do Expats Need Form 2555? Form 2555 Foreign Earned Income Exclusion – An Introduction. Provided an individual is able to establish that his tax home is outside the U.S. and can satisfy either the “bona fide residence test” or the “physical presence test,” such individual can exclude a portion of their earned income earned overseas.

Foreign Earned Income. Tax form 2555 is used to figure the foreign earned income exclusion and housing exclusion or deduction. Taxpayers may be able to claim an exclusion for income earned while they lived and worked in a foreign country if they qualify under the bona fide residence test or the physical presence test and if they have a foreign tax home. 3/25/2019 · Form 2555 can make an expat’s life a lot easier! This form helps expats elect to use the Foreign Earned Income Exclusion (FEIE), one of the biggest money-savers in the expat realm. Read our guide below and follow the simple instructions to Form 2555, and you’ll be saving money in no time at all. Why Do Expats Need Form 2555?

Form 2555 Foreign Earned Income Exclusion – An Introduction. Provided an individual is able to establish that his tax home is outside the U.S. and can satisfy either the “bona fide residence test” or the “physical presence test,” such individual can exclude a portion of their earned income earned overseas. Form 2555 instructions. Form 2555 Part I requires expats to enter their name, address, employer’s details (if applicable), and details of their Tax Home. Part II is for expats claiming using the Bona Fide Residence Test. Alternatively, expats claiming under the Physical Presence Test should fill in part III.

10/30/2019В В· IRS Form 2555 is important if you have foreign income. You can find instructions for how to fill IRS Form 2555 in this articles as well as the smart filler. PDFelement - Edit, Annotate, Fill and Sign PDF Documents. Get from App Store. Get. PDFelement - Read, Annotate and Sign PDF. Instructions for Form 2555: 2006 Tax Year: Specific Instructions This is archived information that pertains only to the 2006 Tax Year. If you are looking for Instead, attach a statement to Form 2555 showing how you figured the exclusion. Enter the amount that would have been excludable in 2005 on Form 2555 to the left of line 45.

How much time does it take to prepare this form? Per IRS form 2555 instructions, US expats will spend an average of 2.5 hours to prepare and file the form. Forms 2555 EZ will take even less time. Is it a requirement to file this form? American expats can file IRS form 2555/2555 EZ, form 1116 or both forms. Form 2555 Department of the Treasury Internal Revenue Service Foreign Earned Income Attach to Form 1040. Information about Form 2555 and its separate instructions is at

Form 2555 Foreign Earned Income 0MB13~93No. 1545-0067 Department of the Treasi,rh ~ See separate instructions. ~ Attach to front of Form 1040. Attachment Internal Revenue Service Sequence No 34 For Use b U.S. Citizens and Resident Aliens Oni Name shown on Form 1040 Yoursocial security number Form 2555 Department of the Treasury Internal Revenue Service Foreign Earned Income Attach to Form 1040. Information about Form 2555 and its separate instructions is at

Instructions for Form 2555 (2006) Uncle Fed's Tax*Board. Fill Online, Printable, Fillable, Blank Foreign Earned Income Exclusion Form 2555-EZ Form. Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Instructions for Form 1040 if …, Form 2555 Foreign Earned Income 0MB13~93No. 1545-0067 Department of the Treasi,rh ~ See separate instructions. ~ Attach to front of Form 1040. Attachment Internal Revenue Service Sequence No 34 For Use b U.S. Citizens and Resident Aliens Oni Name shown on Form 1040 Yoursocial security number.

Form 2555 Foreign Earned Income 0MB13~93

Instructions for IRS Form 2555 Foreign Earned Income. Form 2553, Election by a Small Business Corporation, is used by small businesses to elect to be taxed as a "Subchapter S - Corporation" (S corporation). Form 2555, Foreign Earned Income, is filed by taxpayers who have earned income from sources outside the United States exempt from U.S. income tax. U.S. citizens or resident aliens are taxed on, ProConnect Tax Online and ProConnect Lacerte will not generate Form 2555, Foreign Earned Income Exclusion, when Form 1040NR is generated because: Form 2555 is for use by U.S. Citizens and Resident Aliens only. Form 1040NR is for use by U.S. Nonresident Aliens. Related Topics Instructions for Form 1040NR Instructions for Form 2555.

Physical Presence Test Form 2555

Printable 2018 Federal Form 2555 (Foreign Earned Income). Form 2555 Department of the Treasury Internal Revenue Service Foreign Earned Income Attach to Form 1040. Information about Form 2555 and its separate instructions is at https://en.m.wikipedia.org/wiki/Talk:Bangor_Academy_and_Sixth_Form_College Instructions for Form 2555: 2006 Tax Year: Specific Instructions This is archived information that pertains only to the 2006 Tax Year. If you are looking for Instead, attach a statement to Form 2555 showing how you figured the exclusion. Enter the amount that would have been excludable in 2005 on Form 2555 to the left of line 45..

A form that one files with the IRS to claim a foreign earned income exclusion from U.S. taxation of income earned in a foreign country. One may file Form 2555 regardless of the amount one earns abroad, but the maximum exclusion is $92,900 (as of 2011). Form 2555 Instructions and Tips for US Expat Tax Payers Patrick Evans - 21/09/2015. Understanding Form 2555 (the Foreign Earned Income Exclusion and the Foreign Housing Exclusion) is extremely important because it allows U.S. tax payers living and working abroad to exclude all or most of their foreign earned income.

Form 2555 Instructions and Tips for US Expat Tax Payers Patrick Evans - 21/09/2015. Understanding Form 2555 (the Foreign Earned Income Exclusion and the Foreign Housing Exclusion) is extremely important because it allows U.S. tax payers living and working abroad to exclude all or most of their foreign earned income. Instructions for Form 2555, Foreign Earned Income: Related Forms. Form 2555-EZ Foreign Earned Income Exclusion: Instructions for Form 2555-EZ, Foreign Earned Income Exclusion Publications. Links Inside Publications. Publication 54 - Tax Guide for U.S. Citizens and Resident Aliens Abroad - Form 2555 and Form 2555-EZ.

2016 Instructions for Form 2555 - Internal Revenue Service You qualify for the tax benefits available to taxpayers who have foreign earned income if both of the following apply.You meet the … Download Printable Irs Form 2555 In Pdf - The Latest Version Applicable For 2019. Fill Out The Instructions For Irs Form 2555 - Foreign Earned Income Online And Print It Out For Free. Irs Form 2555 Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms, United States State Legal Forms And United States Legal Forms.

4/10/2009В В· Form 2555- Foreign Earned Income 2008 See separate instructions. Attach to Form 1040. Attachment Department of the Treasury 34 Sequence No. Internal Revenue Service For Use by U.S. Citizens and Resident Aliens Only Name shown on Form 1040 Your social security number Part I General Information 1 Your foreign address (including country) 2 Form 2555 Instructions and Tips for US Expat Tax Payers Patrick Evans - 21/09/2015. Understanding Form 2555 (the Foreign Earned Income Exclusion and the Foreign Housing Exclusion) is extremely important because it allows U.S. tax payers living and working abroad to exclude all or most of their foreign earned income.

A form that one files with the IRS to claim a foreign earned income exclusion from U.S. taxation of income earned in a foreign country. One may file Form 2555 regardless of the amount one earns abroad, but the maximum exclusion is $92,900 (as of 2011). Form 2555 Department of the Treasury Internal Revenue Service Foreign Earned Income Attach to Form 1040. Information about Form 2555 and its separate instructions is at

Today, we are going to discuss the foreign housing exclusion, also referred to in form 2555, parts 6, 8 and 9. The foreign housing exclusion is a great way a U.S. expat can reduce their U.S. tax burden. However, the rules are cumbersome and confusing so make sure you pay attention while I walk you […] Instructions and Help about Form 2555-EZ. Music this video discusses form 2555 and the foreign earned income exclusion first we will briefly go over the requirements to claim the exclusion and then we will review the form line by line to simplify the video we will not be going over the housing deduction which is generally applicable to self-employed individuals if you are a US citizen or a u.s

A form that one files with the IRS to claim a foreign earned income exclusion from U.S. taxation of income earned in a foreign country. One may file Form 2555 regardless of the amount one earns abroad, but the maximum exclusion is $92,900 (as of 2011). In this case, the IRS offers US citizen and resident alien taxpayers who expect to file the Form 2555 or Form 2555-EZ and need additional time to meet either the bona fide residence test or the physical presence test to claim the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction.

Form 2555 Department of the Treasury Internal Revenue Service Foreign Earned Income Attach to Form 1040. Information about Form 2555 and its separate instructions is at 3/25/2019 · Form 2555 can make an expat’s life a lot easier! This form helps expats elect to use the Foreign Earned Income Exclusion (FEIE), one of the biggest money-savers in the expat realm. Read our guide below and follow the simple instructions to Form 2555, and you’ll be saving money in no time at all. Why Do Expats Need Form 2555?

Instructions for Form 2555: 2006 Tax Year: Specific Instructions This is archived information that pertains only to the 2006 Tax Year. If you are looking for Instead, attach a statement to Form 2555 showing how you figured the exclusion. Enter the amount that would have been excludable in 2005 on Form 2555 to the left of line 45. 10/30/2019В В· IRS Form 2555 is important if you have foreign income. You can find instructions for how to fill IRS Form 2555 in this articles as well as the smart filler. PDFelement - Edit, Annotate, Fill and Sign PDF Documents. Get from App Store. Get. PDFelement - Read, Annotate and Sign PDF.

11/19/2018В В· Form 2555 and US Expat Taxes. Both Form 2555 and Form 2555-EZ will work when it comes to claiming the Foreign Earned Income Exclusion. The difference between the two forms is primarily the level of difficulty in completing the forms. 11/19/2018В В· Form 2555 and US Expat Taxes. Both Form 2555 and Form 2555-EZ will work when it comes to claiming the Foreign Earned Income Exclusion. The difference between the two forms is primarily the level of difficulty in completing the forms.

How much time does it take to prepare this form? Per IRS form 2555 instructions, US expats will spend an average of 2.5 hours to prepare and file the form. Forms 2555 EZ will take even less time. Is it a requirement to file this form? American expats can file IRS form 2555/2555 EZ, form 1116 or both forms. Instructions for Form 2555: 2006 Tax Year: Specific Instructions This is archived information that pertains only to the 2006 Tax Year. If you are looking for Instead, attach a statement to Form 2555 showing how you figured the exclusion. Enter the amount that would have been excludable in 2005 on Form 2555 to the left of line 45.

Journal Bearing - Free download as Powerpoint Presentation (.ppt), PDF File (.pdf), Text File (.txt) or view presentation slides online. Scribd is the world's largest social reading and publishing site. Journal bearing calculation pdf Marlborough Journal Bearing Test Machine Figure 1 shows the journal bearing test machine used in this study. Using this machine, the journal bearing of the crankshaft in the reciprocating compressor can be tested “as is” with slight modification. Crankpin is removed