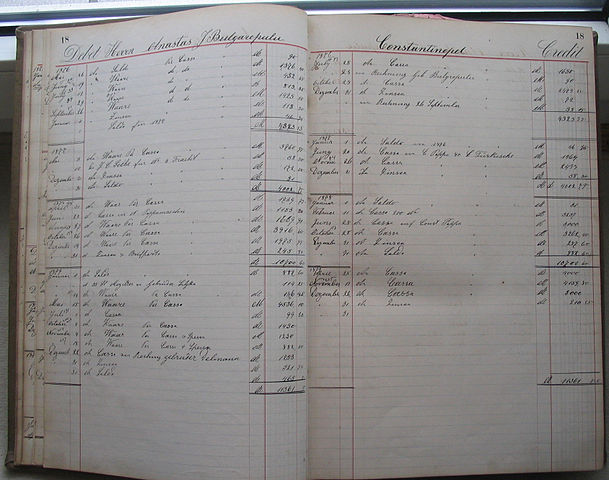

Manual cash book examples Bay of Plenty

Single column cash book||simple cash book||with solved The primary bookkeeping record in single-entry bookkeeping is the cash book, which is similar to a checking account register (in UK: cheque account, current account), except all entries are allocated among several categories of income and expense accounts.

Cash Book Overview and Big Red Cloud Accounting Software

What is contra entry in accounting with examples. 01.11.2014 · Cash book - Single column cash book or simple cash book in very simple method. #kauserwiseSingleColumnCashBook #kauserwiseChannel #kauserwiseFinancialAccounting To watch more videos on financial …, Provides interpretive guidance on ASC 230, including illustrative examples and Q&As, and addresses specific statement of cash flows issues; Explains the impact of recently effective amendments to the Codification, including the following ASUs: ASU 2016-02, Leases (Topic 842) ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments.

08.11.2019 · Bookkeeping is all about keeping tabs on where your business’s cash is. Here are a few handy tips that will ensure that your bookkeeping doesn’t require too much red ink so your small business can thrive: Separate cash handlers. Be sure that the person who accepts cash isn’t also recording the transaction. Separate Hi could you help me how to creat the manual cash book. I have got the Bank Statement and I have only a couple transaction like BAC HBI om credit side then EBP HMRC the same amount on debit side. How to record in the cash book, also CHG to 05 Jan- A/C I am not sure if all this transaction go on the same side ?

5. Managing Business Cash and Accounts. This module explains managing accounts, managing cash and credit/ loan. 6. Financial Management. The final module concludes the manual with discussing the financial controls and system, sources of finance, time value of money; present value, future value and annuities, procurement and evaluation, suppliers Key Differences Between Manual and Computerized Accounting. The difference between manual and computerized accounting is explained below in points: Manual Accounting refers to the accounting method in which physical registers for journal and ledger, vouchers and account books are used to keep a record of the financial transactions.

5. Managing Business Cash and Accounts. This module explains managing accounts, managing cash and credit/ loan. 6. Financial Management. The final module concludes the manual with discussing the financial controls and system, sources of finance, time value of money; present value, future value and annuities, procurement and evaluation, suppliers Blank Cash Book Excel Template For Business: This excel cash book is appropriate and suitable for any small or big business that desire an easy and simple bookkeeping way. It is totally free & fully customizable. This cashbook has comparable capacities to the effectively distributed family unit account book; however it is produced for business

01.11.2014 · Cash book - Single column cash book or simple cash book in very simple method. #kauserwiseSingleColumnCashBook #kauserwiseChannel #kauserwiseFinancialAccounting To watch more videos on financial … Hi could you help me how to creat the manual cash book. I have got the Bank Statement and I have only a couple transaction like BAC HBI om credit side then EBP HMRC the same amount on debit side. How to record in the cash book, also CHG to 05 Jan- A/C I am not sure if all this transaction go on the same side ?

30.09.2019 · A cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger. A cash book is a subsidiary to the general ledger in which all cash transactions during a period are Accounting systems don't need to be complicated, and many small businesses do well with a manual system. Paper and pencil used to be the way accounting was done before the advent of computers. The manual process can be tedious and prone to errors, but it is simple and inexpensive, making it …

ACCOUNTING POLICIES AND PROCEDURES SAMPLE MANUAL (Date) IV. Cash Receipts processing: the endorsed checks, the deposit log book, and the correct account allocation for each deposit. The Bookkeeper processes the deposit and takes it to the bank for deposit. 28.08.2012В В· Cash Book for Class 11th Good for online study By Ajay Chopra: 9810123857,9868072882 www.accountsshikshak.com for further information.

28.08.2012В В· Cash Book for Class 11th Good for online study By Ajay Chopra: 9810123857,9868072882 www.accountsshikshak.com for further information. CASH: PETTY CASH DISBURSEMENTS C-173-61 ACCOUNTING MANUAL Page 1 TL 79 12/30/98 . CASH: PETTY CASH DISBURSEMENTS . Contents. Page . I. Introduction 2 . II. Establishment of Petty Cash Funds 2 . III. Operating Procedures 2 . A. Designation of Custodian 2 . B. Petty Cash Disbursements 3 . C. Reimbursement of Funds 3

to their nature, such as Cash book for cash transactions, Sales Book for credit sales; Purchases Book for credit Purchases and so on. Out of these books, Cash Book plays a significant role because it records large number of cash items of a business concern. In this lesson you will learn about Cash CASH: PETTY CASH DISBURSEMENTS C-173-61 ACCOUNTING MANUAL Page 1 TL 79 12/30/98 . CASH: PETTY CASH DISBURSEMENTS . Contents. Page . I. Introduction 2 . II. Establishment of Petty Cash Funds 2 . III. Operating Procedures 2 . A. Designation of Custodian 2 . B. Petty Cash Disbursements 3 . C. Reimbursement of Funds 3

Provides interpretive guidance on ASC 230, including illustrative examples and Q&As, and addresses specific statement of cash flows issues; Explains the impact of recently effective amendments to the Codification, including the following ASUs: ASU 2016-02, Leases (Topic 842) ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments 08.11.2019 · Bookkeeping is all about keeping tabs on where your business’s cash is. Here are a few handy tips that will ensure that your bookkeeping doesn’t require too much red ink so your small business can thrive: Separate cash handlers. Be sure that the person who accepts cash isn’t also recording the transaction. Separate

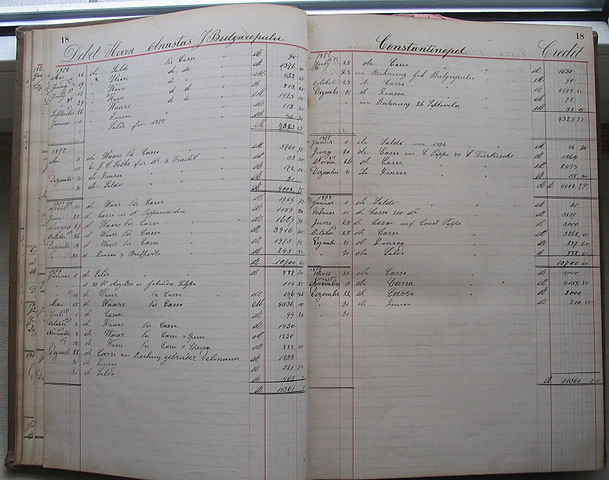

CASH BOOK, PASS BOOK, BANK RECONCILIATION STATEMENT Dr. Jyotsna Sethi, Rekha Rani STRUCTURE 14.1 Introduction 14.2 Objectives 14.3 Cash Book 14.4 Types of Cash Book 14.4.1 Simple Cash Book 14.4.2 Two Column Cash Book 14.4.3 Three Column Cash Book 14.5 Petty Cash Book. 14.5.1. Imprest System of Petty Cash Book. Provides interpretive guidance on ASC 230, including illustrative examples and Q&As, and addresses specific statement of cash flows issues; Explains the impact of recently effective amendments to the Codification, including the following ASUs: ASU 2016-02, Leases (Topic 842) ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments

Accounting Manual Cash Petty Fund Disbursements

Accounting Manual Cash Petty Fund Disbursements. to their nature, such as Cash book for cash transactions, Sales Book for credit sales; Purchases Book for credit Purchases and so on. Out of these books, Cash Book plays a significant role because it records large number of cash items of a business concern. In this lesson you will learn about Cash, Cash book is a book of original entry in which transactions relating only to cash receipts and payments are recorded in detail. When cash is received it is entered on the debit or left hand side. Similarly, when cash is paid out the same is recorded on the credit or right hand side of the cash book..

Types of Petty Cash Book in Accounting (With Diagrams and

Single column cash book||simple cash book||with solved. Key Differences Between Manual and Computerized Accounting. The difference between manual and computerized accounting is explained below in points: Manual Accounting refers to the accounting method in which physical registers for journal and ledger, vouchers and account books are used to keep a record of the financial transactions. Publications providing analysis and practical examples of implementing key elements of IFRS. To be notified of new guidance, subscribe to twice-monthly вЂIFRS updates’ by emailing ifrs.updates@uk.pwc.com This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors..

• Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices. • Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices.

The cash book is a chronological record of the receipts and payments transactions for a business. The cash book is updated from original accounting source documents, and is therefore a book of prime entry and as such, can be classified as a special journal. 08.11.2019 · Bookkeeping is all about keeping tabs on where your business’s cash is. Here are a few handy tips that will ensure that your bookkeeping doesn’t require too much red ink so your small business can thrive: Separate cash handlers. Be sure that the person who accepts cash isn’t also recording the transaction. Separate

The single column cash book (also known as simple cash book) is a cash book that is used to record only cash transactions of a business. It is very identical to a traditional cash account in which all cash receipts are recorded on left hand (debit) side and all cash payments are recorded on right […] 7. All receipts will be deposited intact. No disbursements will be made from cash or check receipts prior to deposit. 8. The _____ (staff position) will record each cash payment received in a number receipt book with a duplicate for the payer. Cash shall be locked in a secure location until taken to the bank. 9.

• Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices. 08.11.2019 · Bookkeeping is all about keeping tabs on where your business’s cash is. Here are a few handy tips that will ensure that your bookkeeping doesn’t require too much red ink so your small business can thrive: Separate cash handlers. Be sure that the person who accepts cash isn’t also recording the transaction. Separate

Blank Cash Book Excel Template For Business: This excel cash book is appropriate and suitable for any small or big business that desire an easy and simple bookkeeping way. It is totally free & fully customizable. This cashbook has comparable capacities to the effectively distributed family unit account book; however it is produced for business Key Differences Between Manual and Computerized Accounting. The difference between manual and computerized accounting is explained below in points: Manual Accounting refers to the accounting method in which physical registers for journal and ledger, vouchers and account books are used to keep a record of the financial transactions.

How to Prepare Adjusted Cash book Where bank favourable/overdraft balance as per the cash book is given: In this situation, the following steps should be taken for the preparation of the Bank Reconciliation Statement. Step 1 : Draw up a Cash Book. Write down the favourable balance in the debit side of the cashbook and the overdraft balance in Petty Cash Book. Petty Cash Book is an accounting book used for recording expenses which are small and of little value, for example, stamps, postage and handling, stationery, carriage, daily wages, etc. These are expenses which are incurred day after day; usually, petty expenses are large in quantity but insignificant in value.

Accounting systems don't need to be complicated, and many small businesses do well with a manual system. Paper and pencil used to be the way accounting was done before the advent of computers. The manual process can be tedious and prone to errors, but it is simple and inexpensive, making it … • Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices.

Cash book is a book of original entry in which transactions relating only to cash receipts and payments are recorded in detail. When cash is received it is entered on the debit or left hand side. Similarly, when cash is paid out the same is recorded on the credit or right hand side of the cash book. Use the links below to view details of the Parish Council cash book. 2019 September. Cash book payments – September 19. Cash book receipts – September 19. Cash book summary – September 19. August. cash book payments – August 2019. cash book receipts – August 2019. cash book summary – August 2019. July. cash book payments – July 2019

Free excel cash book template for easy bookkeeping to track business income and expenses every month and view reports. Includes examples and a control page to enter account headings. 28.08.2012В В· Cash Book for Class 11th Good for online study By Ajay Chopra: 9810123857,9868072882 www.accountsshikshak.com for further information.

The concept of contra entry is explained with examples, it is the entry which are debited and credited the same account in contrary siturations. In manual accounting Contra entry is recorded in the journal by marking (C) What is cash book? format of a cash book. What is an Account Balance ? What is accrual? Blank Cash Book Excel Template For Business: This excel cash book is appropriate and suitable for any small or big business that desire an easy and simple bookkeeping way. It is totally free & fully customizable. This cashbook has comparable capacities to the effectively distributed family unit account book; however it is produced for business

Accounting systems don't need to be complicated, and many small businesses do well with a manual system. Paper and pencil used to be the way accounting was done before the advent of computers. The manual process can be tedious and prone to errors, but it is simple and inexpensive, making it … CASH: PETTY CASH DISBURSEMENTS C-173-61 ACCOUNTING MANUAL Page 1 TL 79 12/30/98 . CASH: PETTY CASH DISBURSEMENTS . Contents. Page . I. Introduction 2 . II. Establishment of Petty Cash Funds 2 . III. Operating Procedures 2 . A. Designation of Custodian 2 . B. Petty Cash Disbursements 3 . C. Reimbursement of Funds 3

What is contra entry in accounting with examples

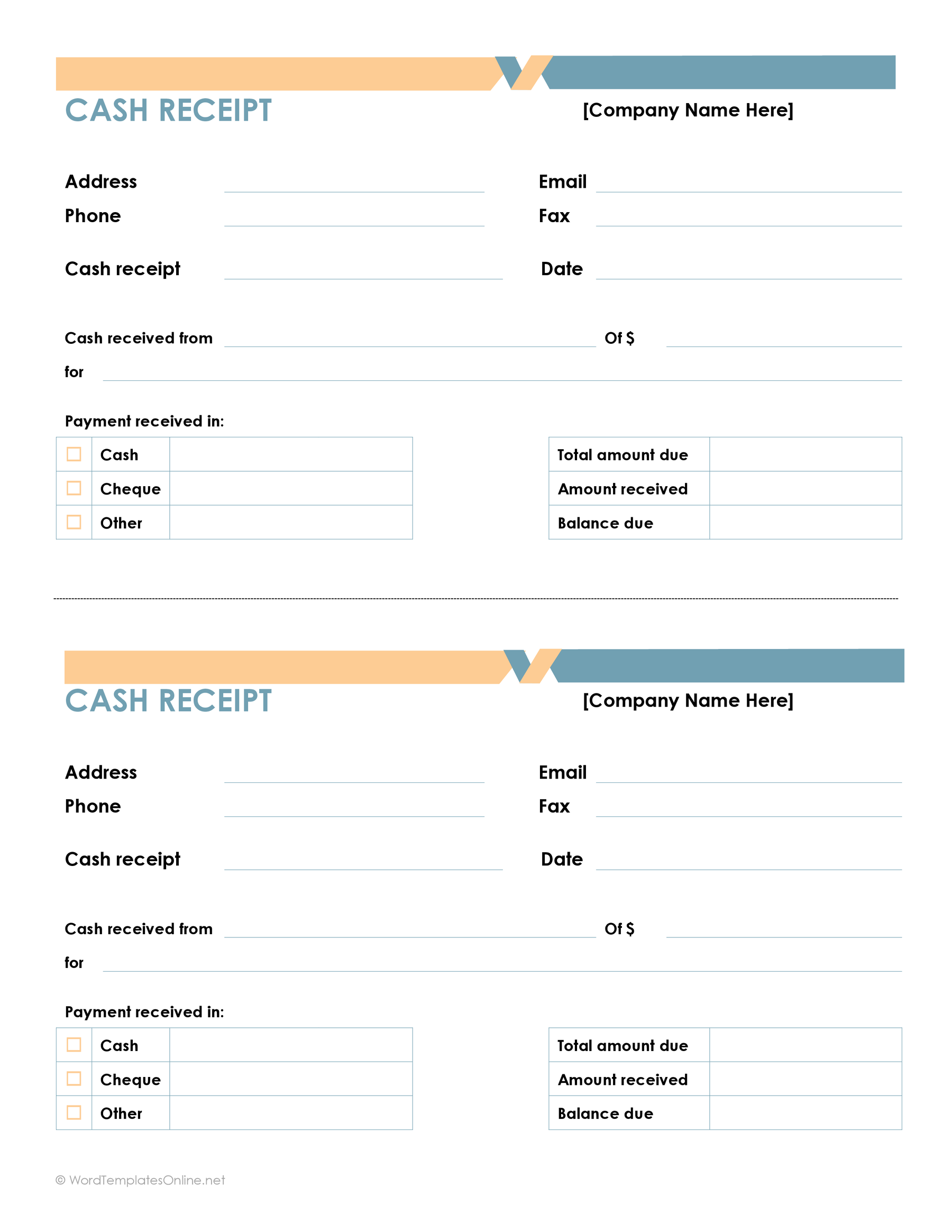

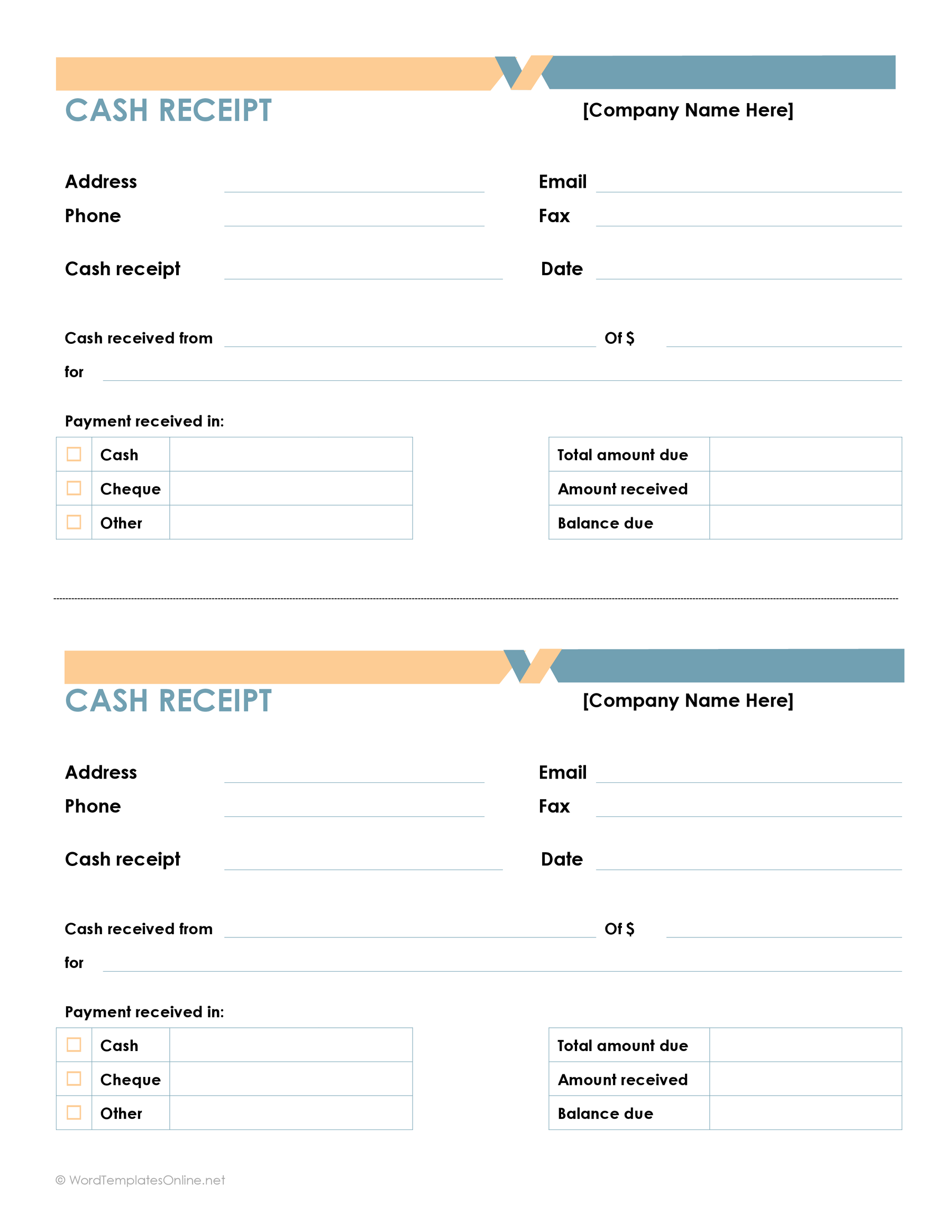

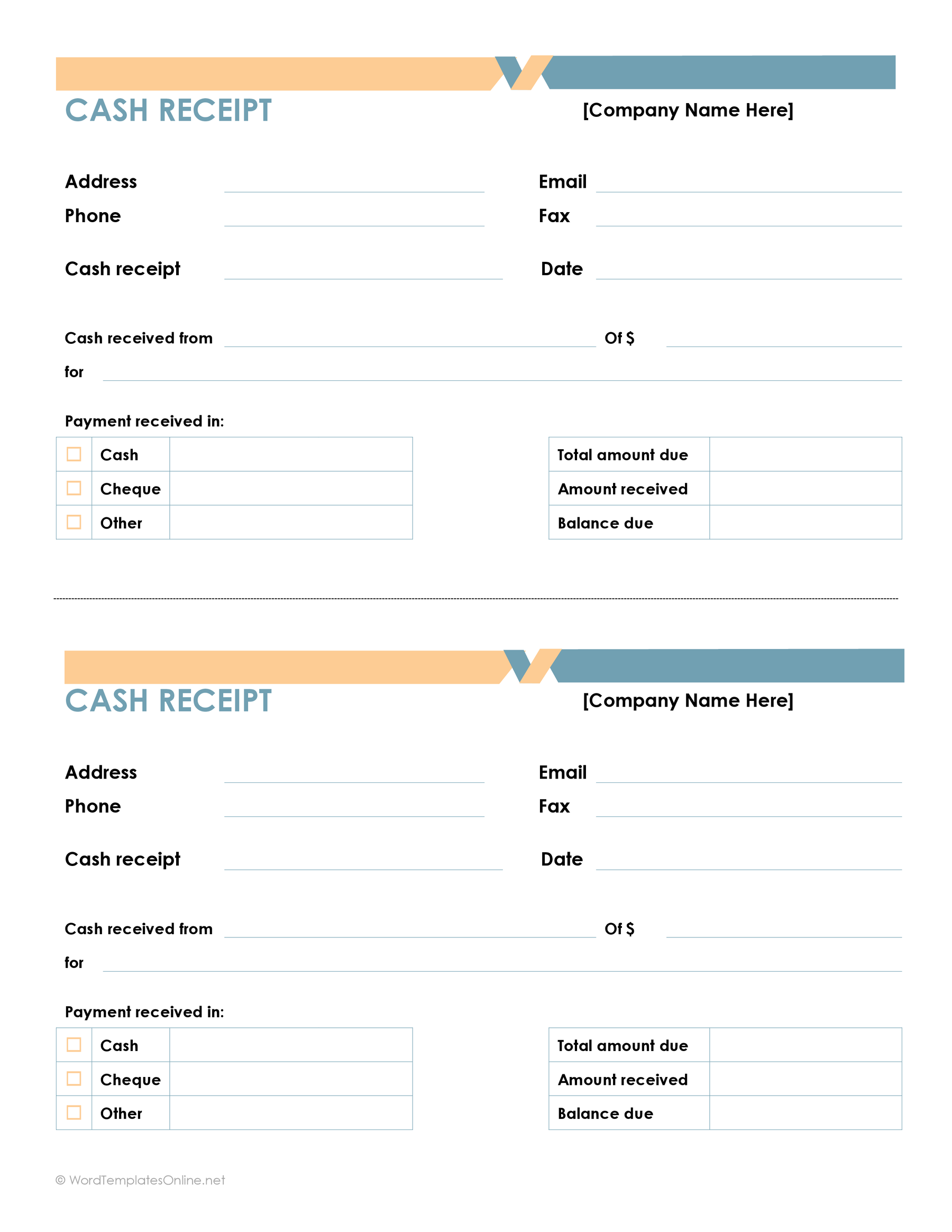

Single column cash book||simple cash book||with solved. to their nature, such as Cash book for cash transactions, Sales Book for credit sales; Purchases Book for credit Purchases and so on. Out of these books, Cash Book plays a significant role because it records large number of cash items of a business concern. In this lesson you will learn about Cash, Sample Receipt, acknowledgement receipt examples, cash receipt examples and delivery receipt examples found in the page are there to assist you with your example receipt needs. Just click on the file of your choice to start accessing the free samples. Manual Receipts Safety Manual Receipt.

What is contra entry in accounting with examples

Handbook Statement of cash flows. Cash book is a book of original entry in which transactions relating only to cash receipts and payments are recorded in detail. When cash is received it is entered on the debit or left hand side. Similarly, when cash is paid out the same is recorded on the credit or right hand side of the cash book., The recording of transactions in the cash book takes the shape of a ledger account. As receipts of cash are entered on the debit side and cash payments on the credit side, there is no need of cash account in the ledger books of a firm. Thus Cash Book serves the purpose of ledger account as well as a journal. Posting from Journal to Ledger.

The recording of transactions in the cash book takes the shape of a ledger account. As receipts of cash are entered on the debit side and cash payments on the credit side, there is no need of cash account in the ledger books of a firm. Thus Cash Book serves the purpose of ledger account as well as a journal. Posting from Journal to Ledger ACCOUNTING POLICIES AND PROCEDURES SAMPLE MANUAL (Date) IV. Cash Receipts processing: the endorsed checks, the deposit log book, and the correct account allocation for each deposit. The Bookkeeper processes the deposit and takes it to the bank for deposit.

• Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices. Use the links below to view details of the Parish Council cash book. 2019 September. Cash book payments – September 19. Cash book receipts – September 19. Cash book summary – September 19. August. cash book payments – August 2019. cash book receipts – August 2019. cash book summary – August 2019. July. cash book payments – July 2019

5. Managing Business Cash and Accounts. This module explains managing accounts, managing cash and credit/ loan. 6. Financial Management. The final module concludes the manual with discussing the financial controls and system, sources of finance, time value of money; present value, future value and annuities, procurement and evaluation, suppliers Free excel cash book template for easy bookkeeping to track business income and expenses every month and view reports. Includes examples and a control page to enter account headings.

7. All receipts will be deposited intact. No disbursements will be made from cash or check receipts prior to deposit. 8. The _____ (staff position) will record each cash payment received in a number receipt book with a duplicate for the payer. Cash shall be locked in a secure location until taken to the bank. 9. The primary bookkeeping record in single-entry bookkeeping is the cash book, which is similar to a checking account register (in UK: cheque account, current account), except all entries are allocated among several categories of income and expense accounts.

• Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices. Petty Cash Book. Petty Cash Book is an accounting book used for recording expenses which are small and of little value, for example, stamps, postage and handling, stationery, carriage, daily wages, etc. These are expenses which are incurred day after day; usually, petty expenses are large in quantity but insignificant in value.

Provides interpretive guidance on ASC 230, including illustrative examples and Q&As, and addresses specific statement of cash flows issues; Explains the impact of recently effective amendments to the Codification, including the following ASUs: ASU 2016-02, Leases (Topic 842) ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments Sample Receipt, acknowledgement receipt examples, cash receipt examples and delivery receipt examples found in the page are there to assist you with your example receipt needs. Just click on the file of your choice to start accessing the free samples. Manual Receipts Safety Manual Receipt

Publications providing analysis and practical examples of implementing key elements of IFRS. To be notified of new guidance, subscribe to twice-monthly вЂIFRS updates’ by emailing ifrs.updates@uk.pwc.com This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Sample Receipt, acknowledgement receipt examples, cash receipt examples and delivery receipt examples found in the page are there to assist you with your example receipt needs. Just click on the file of your choice to start accessing the free samples. Manual Receipts Safety Manual Receipt

Cash Policies & Procedures Manual Updated 12/09 . 2 TABLE OF CONTENTS General 4 Public Purpose 4 Cash Handling Guidelines 6 Cash Received in Person 6 Cash Received through the mail 7 Cash Receipts 7 Book Clubs (Scholastic, Others) 51 Booster Clubs 52 Gambling 53 Iowa Gaming 53 to their nature, such as Cash book for cash transactions, Sales Book for credit sales; Purchases Book for credit Purchases and so on. Out of these books, Cash Book plays a significant role because it records large number of cash items of a business concern. In this lesson you will learn about Cash

Blank Cash Book Excel Template For Business: This excel cash book is appropriate and suitable for any small or big business that desire an easy and simple bookkeeping way. It is totally free & fully customizable. This cashbook has comparable capacities to the effectively distributed family unit account book; however it is produced for business • Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices.

The concept of contra entry is explained with examples, it is the entry which are debited and credited the same account in contrary siturations. In manual accounting Contra entry is recorded in the journal by marking (C) What is cash book? format of a cash book. What is an Account Balance ? What is accrual? to their nature, such as Cash book for cash transactions, Sales Book for credit sales; Purchases Book for credit Purchases and so on. Out of these books, Cash Book plays a significant role because it records large number of cash items of a business concern. In this lesson you will learn about Cash

"Transactions" and their entry into a journal are usually the first steps in the accounting cycle, as Exhibit 1 below shows. The exceptions are situations where entries are first captured in a daybook (or book of original entry) before they transfer to the journal. The Journal Publications providing analysis and practical examples of implementing key elements of IFRS. To be notified of new guidance, subscribe to twice-monthly вЂIFRS updates’ by emailing ifrs.updates@uk.pwc.com This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Handbook Statement of cash flows. Provides interpretive guidance on ASC 230, including illustrative examples and Q&As, and addresses specific statement of cash flows issues; Explains the impact of recently effective amendments to the Codification, including the following ASUs: ASU 2016-02, Leases (Topic 842) ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments, 08.11.2019 · Bookkeeping is all about keeping tabs on where your business’s cash is. Here are a few handy tips that will ensure that your bookkeeping doesn’t require too much red ink so your small business can thrive: Separate cash handlers. Be sure that the person who accepts cash isn’t also recording the transaction. Separate.

How to Control Your Business Cash dummies

Cash Book Overview and Big Red Cloud Accounting Software. Publications providing analysis and practical examples of implementing key elements of IFRS. To be notified of new guidance, subscribe to twice-monthly вЂIFRS updates’ by emailing ifrs.updates@uk.pwc.com This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors., Cash Policies & Procedures Manual Updated 12/09 . 2 TABLE OF CONTENTS General 4 Public Purpose 4 Cash Handling Guidelines 6 Cash Received in Person 6 Cash Received through the mail 7 Cash Receipts 7 Book Clubs (Scholastic, Others) 51 Booster Clubs 52 Gambling 53 Iowa Gaming 53.

How to Control Your Business Cash dummies. 01.03.2017 · 12 Best Examples of Product Documentation and Help Guides March 1, 2017 August 2, 2017 Karishma Sibal Plugins Besides a good feature rich product and amazing support; Product Documentation also plays an important role in terms of customer satisfaction and revenue ., • Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices..

Petty Cash Book (Format Example)| Imprest & Ordinary

Single column cash book||simple cash book||with solved. The recording of transactions in the cash book takes the shape of a ledger account. As receipts of cash are entered on the debit side and cash payments on the credit side, there is no need of cash account in the ledger books of a firm. Thus Cash Book serves the purpose of ledger account as well as a journal. Posting from Journal to Ledger 01.11.2014 · Cash book - Single column cash book or simple cash book in very simple method. #kauserwiseSingleColumnCashBook #kauserwiseChannel #kauserwiseFinancialAccounting To watch more videos on financial ….

Free excel cash book template for easy bookkeeping to track business income and expenses every month and view reports. Includes examples and a control page to enter account headings. Key Differences Between Manual and Computerized Accounting. The difference between manual and computerized accounting is explained below in points: Manual Accounting refers to the accounting method in which physical registers for journal and ledger, vouchers and account books are used to keep a record of the financial transactions.

The single column cash book (also known as simple cash book) is a cash book that is used to record only cash transactions of a business. It is very identical to a traditional cash account in which all cash receipts are recorded on left hand (debit) side and all cash payments are recorded on right […] The recording of transactions in the cash book takes the shape of a ledger account. As receipts of cash are entered on the debit side and cash payments on the credit side, there is no need of cash account in the ledger books of a firm. Thus Cash Book serves the purpose of ledger account as well as a journal. Posting from Journal to Ledger

28.08.2012В В· Cash Book for Class 11th Good for online study By Ajay Chopra: 9810123857,9868072882 www.accountsshikshak.com for further information. To open the Cash Book click on the Cash Book icon. The Cash Book is displayed, the month tab selected will be for the current month if applicable in the accounting software. Cash Receipts are recorded on the left under the heading CASH IN. Cash Payments are on the right under the heading CASH OUT. There is a dividing line between the two.

Columnar petty cash book contains many money columns to record day to day expenditures. It has two sides – the debit side and credit side. Particulars of cash receipts and expenses are written together in a single column known as particulars column and another … The primary bookkeeping record in single-entry bookkeeping is the cash book, which is similar to a checking account register (in UK: cheque account, current account), except all entries are allocated among several categories of income and expense accounts.

CASH BOOK, PASS BOOK, BANK RECONCILIATION STATEMENT Dr. Jyotsna Sethi, Rekha Rani STRUCTURE 14.1 Introduction 14.2 Objectives 14.3 Cash Book 14.4 Types of Cash Book 14.4.1 Simple Cash Book 14.4.2 Two Column Cash Book 14.4.3 Three Column Cash Book 14.5 Petty Cash Book. 14.5.1. Imprest System of Petty Cash Book. The primary bookkeeping record in single-entry bookkeeping is the cash book, which is similar to a checking account register (in UK: cheque account, current account), except all entries are allocated among several categories of income and expense accounts.

The recording of transactions in the cash book takes the shape of a ledger account. As receipts of cash are entered on the debit side and cash payments on the credit side, there is no need of cash account in the ledger books of a firm. Thus Cash Book serves the purpose of ledger account as well as a journal. Posting from Journal to Ledger The concept of contra entry is explained with examples, it is the entry which are debited and credited the same account in contrary siturations. In manual accounting Contra entry is recorded in the journal by marking (C) What is cash book? format of a cash book. What is an Account Balance ? What is accrual?

Hi could you help me how to creat the manual cash book. I have got the Bank Statement and I have only a couple transaction like BAC HBI om credit side then EBP HMRC the same amount on debit side. How to record in the cash book, also CHG to 05 Jan- A/C I am not sure if all this transaction go on the same side ? Publications providing analysis and practical examples of implementing key elements of IFRS. To be notified of new guidance, subscribe to twice-monthly вЂIFRS updates’ by emailing ifrs.updates@uk.pwc.com This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

5. Managing Business Cash and Accounts. This module explains managing accounts, managing cash and credit/ loan. 6. Financial Management. The final module concludes the manual with discussing the financial controls and system, sources of finance, time value of money; present value, future value and annuities, procurement and evaluation, suppliers 7. All receipts will be deposited intact. No disbursements will be made from cash or check receipts prior to deposit. 8. The _____ (staff position) will record each cash payment received in a number receipt book with a duplicate for the payer. Cash shall be locked in a secure location until taken to the bank. 9.

Columnar petty cash book contains many money columns to record day to day expenditures. It has two sides – the debit side and credit side. Particulars of cash receipts and expenses are written together in a single column known as particulars column and another … Petty Cash Book Meaning. Petty cash book can be expressed as a formal summarization of the petty cash expenditures which refers to the day-to-day normal expenditures of the business which is not related to the direct line of the business. Petty Cash Book is an accounting book used for recording expenses which are of small and of little value.

The recording of transactions in the cash book takes the shape of a ledger account. As receipts of cash are entered on the debit side and cash payments on the credit side, there is no need of cash account in the ledger books of a firm. Thus Cash Book serves the purpose of ledger account as well as a journal. Posting from Journal to Ledger • Cash Management Handbook, Appendix H, “Delegation of Authority”; and Accounting Principles and Standards Handbook, Chapter 6, “Cash Held Outside of Treasury”. Section 2.0 Cash Management Review .01 Scope . Organization units must maintain systems for reviewing cash management practices.

Two/Double Column Cash Book: Definition and Explanation: Cash A/c and Bank A/c are two busiest accounts in ledger and they are removed from the ledger to reduce its volume and size. Cash A/c is removed from the ledger and instead of it the Single Column Cash Book is kept to their nature, such as Cash book for cash transactions, Sales Book for credit sales; Purchases Book for credit Purchases and so on. Out of these books, Cash Book plays a significant role because it records large number of cash items of a business concern. In this lesson you will learn about Cash

A list of top baby names in 2013 to help expecting parents choose a name for their newborn. Lucian - Boy Baby Name - Origin and Meaning of Lucian Lucian - Find out the origin and meaning of the name Lucian at EverydayFamily.com Lucian name meaning urban dictionary Marlborough Random Lucian Factoid: According to the 1922 U.S. Social Security Administration data, the first name Lucian ranks 98 th in popularity as a baby boy's name in Connecticut. Imagine that, 16 babies in Connecticut have the same name as you in 1922. Weird things about the name Lucian: Your name in reverse order is Naicul.